We usually use this first investment view of the year to discuss the previous 12 months but given the unusually polarised stock market conditions of the first few weeks of 2026, we will also briefly discuss our current thoughts, and the very attractive opportunity set that we see within the portfolio.

A review of 2025 is included as Appendix I below.

Digital detractors

IFSL Evenlode Income’s information services holdings - about 15% of the portfolio - have been by far the biggest detractors so far in 2026. Many portfolio holdings have posted positive returns but, as I write on 10 February, the fund is down -1.5% year-to-date, with RELX, Experian, LSEG and Sage all falling sharply on concerns around competition from generative AI companies.

We have written separately in detail on this topic over recent days and weeks. In short, we think the sell-off is an overreaction, with valuations beginning to factor in a terminal decline in free cash flow very imminently. We understand the potential risks that generative AI technology brings, but continue to view proprietary datasets, deeply embedded domain expertise, and long-standing trusted client relationships as sources of a formidable competitive advantage for these companies. In particular, we think their unique datasets will become more valuable in the world of generative AI. With any model, the value of the output is defined by the value of the input. Accurate, high-quality data that can be relied on by professionals and their corporates employers to make mission-critical decisions will remain as essential as ever. These risk-averse clients would also prefer to make the transition to a new technology with a trusted partner. Risk management is a huge priority, and security breaches and inaccuracies are to be avoided at all costs. As an experienced AI coder recently put it on an expert call, ‘I like to say the S in AI stands for security - AI code is full of vulnerabilities’.

There are analogies here, we think, with prior technology shifts within the business-to-business information sector, most notably the transition from print to digital in the 2000s and the transition to the cloud in the 2010s. At the time, markets were deeply sceptical about the ability of these companies to make the shift to a new technology paradigm successfully, with their economics intact. Success is never a given - there is no such thing as a perfect company. But we think these holdings are very well placed to succeed in an AI-enabled world, provided they continue to invest in properly harnessing and embedding new AI technology in the services they deliver.

Our determination remains to follow the advice of one seasoned market veteran to us, ‘to own the things you want to own, not the things the market wants you to own’. The large and indiscriminate sell-off has to our minds increased the size of the prize when the structural advantages of these businesses finally register with the market.

A more detailed discussion on RELX is included as Appendix II below, written by my colleague James Knoedler.

A diversified portfolio of excellent, attractively valued companies

Though these digital-orientated holdings are excellent companies, it’s worth noting that for the other 85% of the portfolio, almost all the holdings have at their core a business model that delivers services and products in the physical world.

Digital or not, put them all together and the portfolio’s diverse list of holdings are highly profitable, resilient, low-leverage companies that are growing at a good rate and spinning off a huge amount of cash.

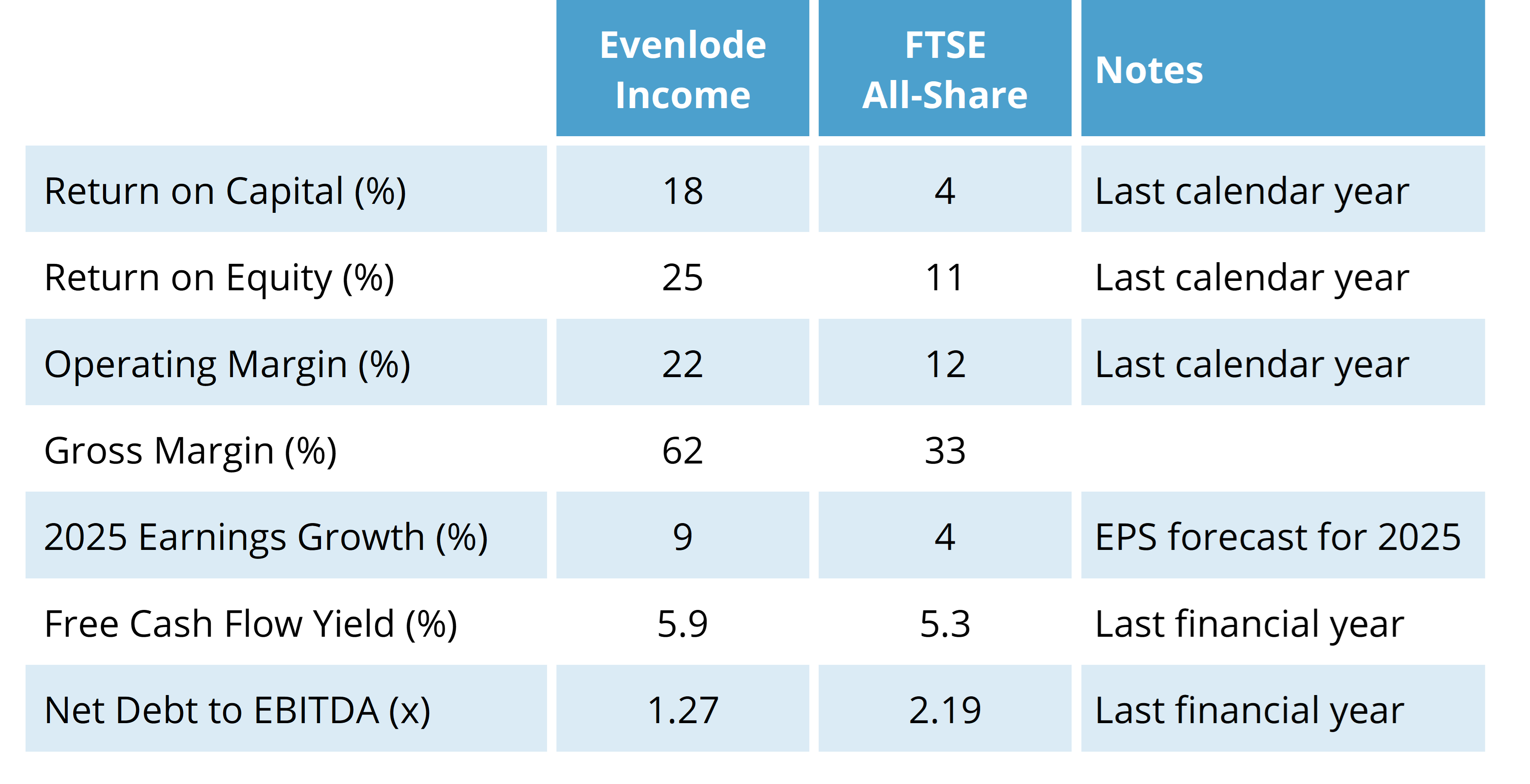

A summary of key portfolio statistics is shown in this table (please see note at end of the document for definitions)i:

Source Bloomberg, Evenlode, 3 February 2026.

That the portfolio has superior fundamental economics compared to the FTSE All-Share Index should not be surprising given our investment approach. What is particularly interesting in the current market is that, despite these qualities, the free cash flow yield of the portfolio is now comfortably cheaper than the UK market.

In the wider global context, this cheapness is even starker. The MSCI World Index’s free cash flow yield is currently 3.1%. Every one of the fund’s 36 holdings is now trading on a higher free cash flow yield than this global stock market average free cash flow yield.

Boring can be beautiful

In markets full of volatility, we think that remaining calm and objective and focusing on the fundamentals of business analysis is crucial. We find our own analysis - as well as the conversations we have with companies, analysts and experts - particularly grounding through such periods.ii

It is a brave person to predict exactly what will happen within global stock markets over coming weeks and months - market trends feel pulled taut and volatility is picking up. If history is a guide though, the beauty of shares in cheap, highly cash generative, low-leverage market-leading companies is unlikely to remain forgotten to Mr Market indefinitely, particularly when the breathless momentum trades of this cycle finally run out of steam, and investors begin to seek diversification away from cyclicality and leverage.

Appendix I: 2025 review

Performance

In a wild year for news headlines, global politics and economics loomed large over stock markets again in 2025. After a strong start, markets took a dive in April following Trump’s liberation day tariffs, before roaring away again for the rest of the year. Narrow leadership remained a big theme - with AI infrastructure stocks dominating the global market benchmark, and asset-intensive cyclical stocks such as banks and miners dominating the UK market benchmark.

For 2025, IFSL Evenlode Income’s return was +0.8% compared to +15.4% for the IA UK All Companies sector and +24.0% for the FTSE All-Share. Since launch in October 2009, this takes the fund’s cumulative total return to +332%, compared to a return of +211% for the IA UK All Companies sector and +250% for the FTSE All-Share.

Source: FE fundinfo, 19 October 2009 to 31 December 2025.

We would rather be reporting better numbers for 2025 – it has been by the far the worst year for relative performance during the fund’s more than 16-year life. The share prices of portfolio holdings were stuck in neutral, whereas the UK market roared upward.

We are frustrated with the lack of progress in the unit price but having spent the year closely checking the health of the companies in the portfolio and testing our investment cases in the face of a changing backdrop (for both technology and geopolitics), we are not disheartened. On the contrary, we think that recent trends are laying the foundations for a promising period for investment.

We are cognisant of the new era that the world has found itself in, with geopolitical alliances shifting, protectionism and nationalism on the rise, and technology evolving rapidly. The changes are profound. Where we think it makes sense, we have and will continue to evolve the portfolio.

Fundamental progress

Despite the very complicated backdrop, aggregate fundamental progress has been solid for the IFSL Evenlode Income portfolio and very similar to that expected at the start of 2025. The portfolio’s earnings are forecast to have grown by +9% in 2025 compared to +4% growth for the UK market.

The big issue for the portfolio’s relative return in 2025 was that the valuation of the fund’s holdings became cheaper, whereas the valuations of many of the big asset-intensive cyclical stocks within the UK market - particularly in the banking and commodity sectors - became more expensive. Sentiment towards banks has been improving over recent years as their interest income margins have benefited from a higher interest rate environment. Commodity stocks have been benefiting from the rising price of industrial and precious metals.

The following chart shows a decomposition of dividends, earnings growth and the change in valuation for the IFSL Evenlode Income portfolio in 2025 compared to the UK market.

Source: Bloomberg, Visible Alpha, Evenlode.

Looking ahead to 2026, the aggregate IFSL Evenlode Income portfolio is expected to grow earnings by over +10%. As it stands, all 36 holdings are expected to grow operating profit during 2026.

Free cash flow valuation

Taking a longer-term view, as UK quality stocks have fallen increasingly out of fashion in recent years, their valuations have become increasingly attractive. A key valuation measure for us is the free cash flow yield, which shows how much excess annual cash flow is being generated relative to the current market valuation of the company, after all expenses and capital expenditure have been paid. The higher this measure, the better: you are getting more annual cash flow for each share you own in a company.

The free cash flow yield for IFSL Evenlode Income is now 6.2% for 2026, and 6.8% for 2027 - levels we haven’t seen since the early days of the fund a decade and a half ago.

Performance attribution

Contributors

The most positive contributors to the fund’s return during the year were Smiths Group, Games Workshop, Reckitt Benckiser, GSK and Smith & Nephew.

Smiths Group reiterated full-year guidance at its trading update in November for organic revenue growth of approximately +5% and profit growth at a higher rate for the current year. The company has also made good progress on the disposals of its Interconnect and Detection business. This leaves Smiths a higher margin, higher-return company and will lead to more than £3bn of cash - 40% of the market capitalisation - coming back to the company over the next six months or so, much of which is to be deployed as share buy backs. We continue to hold the position with the valuation remaining attractive on a 19x P/E ratio and 5% free cash flow yield.

Games Workshop, the fantasy miniatures and table tops games business behind the Warhammer hobby, grew revenue and profit strongly again in 2025. Growing success in the US and Asia on a decade long view would be transformational for the company. We have, though, trimmed back the holding in recent weeks after strong share price performance.

Reckitt executed well on the strategic plan set out in 2024, completing the divestment of the Essential Home business, and driving good growth in its core of higher margin globally leading brands. The US infant nutrition litigation is ongoing, but recent rulings have been favourable for Reckitt. While the shares have rallied, valuation remains attractive, with the shares trading on 17x P/E multiple this year, and 16x next, and we continue to hold the position.

GSK’s portfolio of specialty respiratory, oncology and HIV medicines drove strong growth, leading to guidance upgrades during the year. The appointment of Luke Miels as CEO from 2026 and the agreement with the US administration on drug pricing and investment were also viewed positively as discussed above.

Smith & Nephew made good operational progress during 2025, upgrading free cash flow guidance over the course of the year. Sports Medicine and Wound Management continued to deliver solid growth, while the Orthopaedics improvement programme progressed the business towards category-level growth. We continue to hold the position, with valuation remaining attractive on 15x P/E and a 6% free cash flow yield.

Detractors

The most negative contributors to the fund’s return during the year were Diageo, Bunzl, PageGroup, LSEG and Wolters Kluwer.

Diageo continues to be impacted by weakness in the US spirits category, which we think is primarily a cyclical issue, with affordability pressures on the US consumer being the dominant driver. However, moderation, health and immigration trends are also playing a part. Diageo remains a great British global market leader with an impossible-to-replicate portfolio of brands with authenticity and heritage - not least Guinness. We think the company can grow in the US, just not at the rate it did in the 2010s, and the opportunity in emerging markets - particularly Latin America, India and South-East Asia - remains large. In the near-term, market conditions are tough, though it is not that the company’s earnings and free cash flow have disappeared - in fact free cash flow in 2025 was higher than in 2022, when the share price peaked. The stock is now trading on a PE multiple of 13x and a free cash flow yield of 7%, a valuation level not seen for more than a decade. Dave Lewis began his tenure as CEO at the beginning of January. He is a thoughtful, decisive operator with a wealth of consumer goods experience from leadership roles at Unilever, Tesco and Haleon. We continue to hold the position.

Bunzl, a market leader in B2B distribution of not-for-resale consumables such as packaging and cleaning products, had a challenging year with operational issues at its US business resulting in a profit downgrade in Q1. Management have taken corrective actions and confirmed 2025 guidance in the December trading update. We continue to hold Bunzl with the shares very attractively valued on a P/E multiple of 12x and free cash flow yield of 9%.

PageGroup is a market-leading specialist recruiter with a global footprint. The last few years have been challenging with low churn levels as companies and candidates adopt a wait-and-see approach in the face of geopolitical uncertainties and the shifting technology landscape. PageGroup has weathered the downturn in good shape and has a strong net cash position. We continue to hold a small (0.7%) position as we think PageGroup is well positioned to benefit from the eventual recovery in recruitment markets. The valuation is compelling, with the shares trading on less than 1x annual fees, compared to an historical average around 2.5x.

LSEG’s valuation is at decade lows, as the market seems to be inferring that the whole of its data and analytics revenue - which forms approximately 40% of group revenue - is under threat from generative AI. We view the vast bulk of this revenue as very well protected from disruption risk. LSEG’s data:

- Forms one of the world’s most comprehensive libraries of financial and market data, with decades of history. Much of this is proprietary, including contributions from over 40,000 customers. The company owns more than 33 petabytes of data - three times more than ‘the common crawl’ (the dataset formed by the public internet, which is used to train many large language models).

- Is primarily used for core real-time pricing data in highly sensitive trading environments. As LSEG put it, they are ‘providing millions of hard facts per second, not probabilistic algorithms. In a nutshell, AI cannot replicate or replace our real-time data’.

- Is provided in a clean, connected and consistent way, including the use of LSEG’s industry-standard RICs identification system.

Along with the quality and scale of its datasets, LSEG is also a trusted and highly integrated partner for clients that operate in highly regulated environments. This adds to the high switching costs. Simpler use cases of front-end desktop software that may be more exposed to competition (vs more complex workflows like trading) are a minor part of LSEG’s group revenue. In this area, it is interesting to note the partnership LSEG announced this month with Anthropic, for use of its data within Anthropic’s Claude offering. This is a reminder of the irreplicable nature of LSEG’s data. Users will only be able to access LSEG’s data from within Claude if they have a commercial licence with LSEG. As well as partnering with generative AI offerings, LSEG are also investing in their own generative AI offerings and embedding them in their desktop solutions. LSEG reported third quarter organic revenueiii growth of +6.4% and raised profit guidance for the year.

Portfolio changes in 2025

We exited the small remaining position in Microsoft in January for valuation reasons. In early April we then trimmed back several of the fund’s larger holdings (Unilever, RELX etc.), to manage their position sizes as they strongly out-performed in the ‘liberation day’ sell-off. We broadened out the portfolio by recycling this cash into five new (or reinitiated) holdings: Rightmove, InterContinental Hotels Group, L’Oréal, Auto Trader and AstraZeneca. These are all high quality, cash generative companies that add interesting diversification and growth potential to the portfolio. In May we added Clarkson, the global leader in ship broking, with concerns around US trade policy causing share price weakness, providing an attractive entry point. In August we exited from Spectris, which was subject to a takeover, with proceeds used to initiate a new position in Weir Group. Weir is the global leader in pump technologies for minerals processing and is well set to benefit from structurally growing demand for critical metals such as copper, nickel, lithium and cobalt. In the last few weeks of the year, we tidied up the tail of the portfolio by exiting small positions in Schroders, SGS and Roche following recent share price rises - we have higher conviction in other names in the portfolio. We also exited the small Magnum Ice Cream Company holding that was spun off from Unilever during December. It’s worth noting that the overseas listed exposure in the fund is at its lowest ever, at c.5% (historically it has typically stood at 10-18% of the fund).

In terms of changes to existing holdings during the year, we significantly reduced the positions in Halma and Diploma - both excellent businesses and very well placed, but where valuations have become less compelling thanks to strong share price performance. We also significantly reduced the LVMH position in December after a strong rebound in the share price during the second half of the year. This was to fund additions in UK-listed names where valuations looked more attractive. We also reduced holdings in Victrex, PageGroup and Hays. These reductions reflect balance sheets that are not as strong as they were a year ago, and the funding of additions to a range of holdings where our conviction is particularly high. On the buy-side we topped up a variety of existing positions - the opportunity set is nicely broad.

One notable area of increased exposure included the specialist engineering holdings. As mentioned above, we added a new position in Weir but also increased exposure to Spirax and Rotork. After a difficult post Covid period for industrial end markets, engineering holdings have generally now begun to see more positive demand signals. The longer-term outlook in our view looks well underpinned, thanks to structural trends including investment in energy security, national infrastructure and defence renewal, industrial automation, and the electrification of the industrial sector. Importantly, these holdings benefit from durable competitive advantages, so they can turn that end demand into attractive and durable value creation for shareholders over time.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

10 February 2026

Appendix II: RELX

Last week, share prices of the media and information services sector in Europe were hit hard, triggered by news of an Anthropic plugin which helps legal services build their own workflow software solutions. RELX, which derived 12% of its 2026 operating earnings from legal services, was at Ground Zero.

Before we get into the path ahead for RELX, it’s worth reminding our readers why we own the company. Ultimately RELX is not primarily a workflow provider, but a data provider. Over time the company’s delivery has shifted from physical books to digital services delivered via cloud, but the core differentiation has remained the very specific data and relationships between datasets that they, and only they, can provide to their clients.

The arrival of large language models (LLMs) has radically increased the value of differentiated data. For us the canonical statement of this comes from an OpenAI scientist, James Betker, who in 2023 observed:

‘[T]rained on the same dataset for long enough, pretty much every model with enough weights and training time converges to the same point… This is a surprising observation! It implies that model behavior is not determined by architecture, hyperparameters, or optimizer choices. It’s determined by your dataset, nothing else … when you refer to “Lambda”, “ChatGPT”, “Bard”, or “Claude” then, it’s not the model weights that you are referring to. It’s the dataset.’iv

Quality as well as quantity of data is critical; up to 99.86% of data from the Common Crawl web repositoryv is thrown away before models are trainedvi. We also know that LLMs are far more reliable when trained on, and grounded on, concise and expertly authored data than on common crawl data.

The hallucinations and overgeneralisations intrinsic to LLMs are growing problems in industries which carry strict liability and where client trust is key. This explains the deals struck by Harvey - the bellwether LLM legal start-up - to access legal data from RELX and Wolters Kluwer.

The recent market moves are not related to the core RELX legal business, but to the adjacent opportunity of legal ‘workflow’ - the digital creation, analysis, and filing of legal documents and processes such as opinions, NDAs, discovery, and contract review. This budget consumes 80% of legal firm technology spend whereas citation libraries like LexisNexis and Westlaw make up the remaining 20% (based on broker estimates). RELX certainly has ambitions to grow into this budget over time - which might be impinged upon by other competitors or new entrants if RELX fails to execute well on its Protégé agentic offering. But what the market is ignoring is that prowess in creating workflow tools has no bearing at all on the data assets - nothing has changed here, as probabilistic LLMs intrinsically cannot create a data asset which is totally deterministic (i.e., reliable). RELX’s LexisNexis product relies not just on the very long range of data it has of legal judgements and filings over centuries of case law, but also its taxonomy of connections between them. The reliability and stability of this product is comparable in our minds to the similar asset that lies in the heart of Alphabet, its search index and click-and-query database.

While it may be more difficult to expand the analytics business over time, the citation library at the heart of RELX’s legal business has not lost pricing power. If anything, it has gained power as it will increasingly be used by tools which lack common sense and the ability to generalise. Vibe coding will impact growth rates at the margin, but Legal revenue growth does not need to accelerate to double-digit rates at this valuation.

RELX’s science publishing division Elsevier (31% of 2026 operating profit) has been similarly struck by fears that its analytics business - which in this case is half of the division revenue - will be ‘foreclosed’ by OpenAI and Anthropic tools. This again misses the point, which is in this case that the Cambrian explosion in science paper submissions due to LLMs has massively increased the importance of trusted third-party gatekeepers. A recent paper in Science shows that authors who make the transition publish 50% more papers, but their rejection rate increases dramatically too, showing that the value added by curation is now structurally highervii. We expect that this will increase the differentiation and pricing power of the leading journals, of which RELX has a disproportionate share. Scientists trying to build careers and secure funding now have fewer routes to credibility and profile, while the huge flood of paper ‘issuance’ has made the value of the ‘rating agencies’ even higher for the ‘buyers’ of papers - the institutions which fund them. We think a 5% growth rate for STM is eminently possible even without any progress on the sale of tools. Most of STM’s tools are additionally grounded in the unique data available to RELX, particularly from its unmatched view of the review process and readership and citation patterns, and that these data are exceptionally important to the people who oversee funding grants and career progression.

The rest of RELX’s earnings come from risk and exhibitions (41% and 14% of 2026 operating profit). The Risk business depends on contributory databases which are essentially impossible to replicate with probabilistic software. We expect any headwind from homegrown solutions to be more than offset by an ongoing explosion in fraud rates caused by a shift to agentic commerce and the natural extreme vulnerability of LLMs to prompt injection attacks. We share the view of the market that exhibitions is immune to AI disruption risk, and that its value has actually grown post Covid as the differentiation of in-person events has grown in a world which is increasingly tilted to Teams meetings and remote working.

In 2020-2021 lockdown markets briefly panicked into thinking that the differentiation of exhibitions was gone following the explosive growth of Hopin, a remote conference alternative which for a time commanded a valuation of $7.8bn. What markets were missing was just how different outcomes were from a sales meeting in person with all the key personnel from the other side, as opposed to a sales meeting with a dozen inattentive people busy replying to emails in their main windows. There is a similar confusion going on now as markets are confusing the ability to create new code with the ability to replicate unique and irreplicable content. Ultimately, if the cost to create code collapses towards zero, this still has no negative impact on the value of the business-critical industry-specific data.

Current valuations assume rapid erosion of the pricing power of data assets, which flies in the face of all of everything that we know about LLMs. Even if - especially if - workflow tools were commoditised, that would simply mean that the owners of unique and essential assets could raise their prices to compensate for any analytics revenue they lose (to be clear, this is a very hypothetical scenario). This could be funded from declining workflow budgets.

The opportunity created by herding in a market driven by fear and uncertainty is now extreme for investors with a differentiated view on the controversy.

James Knoedler

February 2026

Evenlode has developed a Glossary to assist investors to better understand commonly used terms.

This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for information purposes only and should not be relied upon as a recommendation to buy or sell securities. Prospective investors should seek independent financial advice.

This document has been produced by Evenlode Investment Management Limited (‘Evenlode’). Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given.

Investment commentary represents the opinions of the Evenlode team at the time of writing and does not constitute investment advice. Where opinions are expressed, they are based on current market conditions, may differ from those of other investment professionals and are subject to change without notice. Any forecasts provided are subject to change and are not guaranteed.

IFSL Evenlode Income is a sub-fund of the IFSL Evenlode Investment Funds ICVC. Full details of the Evenlode Funds, including risk warnings, are published in the IFSL Evenlode Investment Funds Prospectus and the IFSL Evenlode Investment Funds Key Investor Information Documents (KIIDs) which are available on request and at www.evenlodeinvestment.com.

The IFSL Evenlode Investment Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. You should therefore regard your investment as long term. As a focused portfolio of between 30 and 50 investments, IFSL Evenlode Income may carry more risk than a fund spread over a larger number of stocks. The funds have the ability to invest in derivatives for the purposes of efficient portfolio management (techniques used by investment managers to manage a portfolio in a way that aims to improve returns, reduce risk, or manage costs, without significantly changing the overall investment strategy or risk profile), which may restrict gains in a rising market. Investments in overseas equities may be affected by changes in exchange rates, which could cause the value of your investment to increase or diminish.

Past financial performance is not a reliable indicator of future results. Fund performance figures are shown inclusive of any reinvested income and net of ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Tax treatment depends on individual circumstances and may change in the future.

Market data is sourced from S&P Capital IQ, Financial Express Analytics and Bloomberg unless otherwise stated.

Evenlode believes that delivering real, durable returns over the long term can be best achieved by integrating environmental, social and governance (ESG) factors into the risk management framework as this ensures that all long-term risks are monitored and managed on an ongoing basis. In addition to reviewing ESG factors when making investment decisions, Evenlode engages with portfolio companies on a range of ESG issues (for example greenhouse gas emission reduction). However, please note that the fund does not have a sustainability objective.

This document is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The sale of shares of the fund may be restricted in certain jurisdictions. In particular shares may not be offered or sold, directly or indirectly in the United States or to U.S. Persons, as is more fully described in the Fund's Prospectus.

FTSE® is a trademark of the relevant London Stock Exchange Group plc (“LSE Group”) companies and is used under licence. FTSE Russell is a trading name of certain LSE Group companies. All rights in FTSE Russell indices and data vest in the relevant LSE Group company. Neither LSE Group nor its licensors accept any liability for errors or omissions in the indices or data, and no reliance should be placed on this information. Redistribution of LSE Group data is prohibited without prior written consent. LSE Group does not promote, sponsor, or endorse the content of this communication.

Evenlode is a trading brand of Evenlode Investment Management Limited. Authorised and regulated by the Financial Conduct Authority, No. 767844. Investment Fund Services Limited (IFSL) is authorised and regulated by the Financial Conduct Authority, No. 464193.

Footnotes

-

Definitions:

Return on Capital - A measure of how effectively a company uses total capital (equity and debt) to generate profits.

Return on Equity - A measure of how effectively a company uses shareholder equity to generate profits.

Operating Margin – Operating profit as a percentage of revenue. A measure of how much profit a company makes from its core business operations for every pound of sales, before interest and taxes are taken into account.

Gross Margin - How much money a company keeps from its sales after paying for the direct costs of making its products or delivering its services.

Earnings Growth – The rate at which a company’s profits increase over time. Based on Earnings per Share (EPS), calculated by dividing a company’s profit by the number of shares in issue.

Free Cash Flow Yield – Free Cash Flow (FCF) is a measure of how much cash a company can generate over and above normal operating expenses and capital expenditure. The more FCF a company has, the more it can allocate to dividend payments and growth opportunities. FCF yield is FCF per share divided by the current share price. A higher Free Cash Flow Yield implies a company is generating more cash that could be paid out as dividends and to reinvest into growth of the business.

Net Debt to EBITDA - A measure of the level of debt of a company relative to current level of earnings. EBITDA stands for Earnings before Interest, Taxes, Depreciation, and Amortisation.

-

Organic revenue excludes impact of mergers and acquisitions and also foreign exchange.

-

Common Crawl is a non-profit organisation which acts as a library of the internet’s over 300 billion web pages.

-

Plaintiffs’ Remedies Proposed Findings of Fact, USA et al vs Google LLC, II.A.77.

-

“Scientific Production in the era of Large Language Models’, Science vol. 390 number 6779.