Introduction

The Evenlode UK Select fund has increased +4.7% sinch launch to 31 July 2025, versus +7.4% for the FTSE All-Sharei.

Stock markets have recovered sharply from the post-Liberation-Day lows in April. Sentiment was helped by the postponement of reciprocal tariffs, the sense that negotiations on trade agreements were making progress, and economic data holding up relatively well in the face of uncertainty. After a short interlude during the spring sell-off, global market leadership has resumed its narrow focus, with Artificial Intelligence (AI) exposed US technology shares and financial shares being the key drivers of stock market returns.

Within the UK market context, quality shares have been notably unfashionable, with UK market leadership narrow. The portfolio’s lack of exposure to banks, insurers and defence stocks has been a big headwind for relative returns since launch.

Fundamentals

We continue with our usual approach - investing in quality UK companies for long-term income and growth. We are long-term holders by temperament, but we are always open to change and continue to ‘nudge’ towards those ideas in which we have the highest conviction on quality, valuation appeal and growth.

Evenlode UK Select is a diversified list of very good market-leading UK companies, and recent results have been impressive in aggregate, particularly given that they are reporting on a period that featured a very high level of geopolitical and tariff turmoil. Over 80% of the portfolio has updated the market since the start of July mostly with first half results or second quarter trading updates. Reporting holdings have posted aggregate growth of +5% for organic revenue, +7% for organic profit, and +10% for earnings per share (EPS) growth over their most recent periodii. Valuations look good too - the portfolio’s current free cash flow yield (FCFY)iii is 5.3% and forecast to be 5.8% next year.

Global market leaders

A good example of the high-quality businesses that underpin the portfolio is Clarkson. Founded in 1852, Clarkson plays a vital intermediary role in facilitating the global movement of key commodities, such as crude oil and iron ore. Its extensive global networks of ship charterers and vessel owners, and specialist insights on demand/supply dynamics, underpin its strong competitive position, with number one or two positions across its core ship broking markets. Its advisory arm, port services and industry research further embed Clarkson with customers. Broking generates the bulk of profit, with the company earning commission based on the freight rate for each voyage. The business has been built primarily through an organic-led strategy, driving strong returns on capital and through-cycle growth, with revenue and profit compounding at c10% since 2006. The first six months of the year were tough for Clarkson, as tariff uncertainty caused weakness in freight rates. We viewed this as an attractive entry point for a market-leading business with interesting structural growth prospects, and a current dividend yield and FCF yield of 3.2% and 4.7% respectively. The company also runs with, as Clarkson’s Chair puts it, a ‘war chest’ balance sheet – with over £200m of cash – and the dividend was recently increased for the 23rd consecutive year. Interim results were weak (organic revenue -4% and earnings -24%), though better than expected, as Clarkson continues to take market share and bring new teams of brokers on board. The company also continues to develop its market intelligence offering - a key part of its competitive advantage, which benefits hugely from the vast amount of data that flows through its network every day. Looking ahead, Clarkson’s market is cyclical but also underpinned by structural trends. Sea transportation remains essential for global economic activity, facilitating around 85% of all trade flows, and helping to marry global demand/supply mismatches in critical commodities. Additionally, structural shortages in ship supply - a legacy of the post-Global Financial Crisis decline in shipbuilding capacity - and tightening fuel efficiency regulations, offer further support for freight rates. Clarkson sits in the middle of this global network, connecting a wide array of ship owners and users, and is well positioned to benefit from these trends.

Since launch we have continued to build exposure in several positions including Auto Trader, AstraZeneca and IHG.

Drivers of return: Stock view

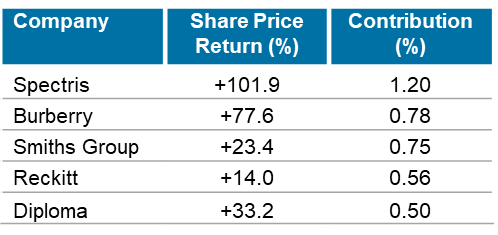

Top Contributors

Total Return, GBP terms. Source: Bloomberg.

The most positive contributors to return were Spectris, Burberry, Smiths Group, Reckitt, and Diploma.

Spectris is a global market leader in the test and measurement instrumentation sector. The share price increased following a takeover approach from Advent, and a subsequent bidding war with KKR then ensued. The latest accepted offer from KKR is at a level approximately double the undisturbed share price prior to Advent’s initial bid. Prior to the bid emerging, Spectris shares were trading on an unusually depressed Price/Earnings (P/E)iv multiple of 13x current year earnings, compared to an average P/E multiple of 17x over the last decade. For context, the bid values the company at a P/E multiple in the mid-20s, more in line with the US instrumentation peer-group. It is a reminder of the embedded value that we see in a diverse range of UK-listed quality businesses. Though many have been out of fashion over the last couple of years, we think the opportunity for the patient investor is compelling.

Burberry’s full year results were ahead of analyst forecasts with improved profitability in the second half, and management guided to further margin improvement in the year ahead. Since joining Burberry in July last year, CEO Joshua Schulman has made good strategic and commercial progress.

Smiths Group is a high-quality engineering franchise with market leadership in its niche areas of focus. The company has raised investment levels, helping drive a pick-up in organic revenue growth. Growth prospects are also supported by growing investment in areas such as energy security, energy efficiency, infrastructure and defence. Year-on-year organic revenue growth for Smiths Group’s most recent quarter was +10.6%. Longer-term, the company’s aspiration is to grow organic revenue at +5-7% and earnings at a double-digit rate. The company also announced the likely disposal of two of its divisions in January, to focus on its John Crane and Flex-Tek divisions which are the most profitable and highest return-on-capital divisions within the group. Smiths Group’s valuation remains attractive, particularly in the context of its growth prospects. Shares currently trade on a dividend yield of 2%, and a FCFY of 4%.

Reckitt’s interim results, released in July, were encouraging, with market share gains, better than expected results, and a raise in guidance for this year’s group organic revenue growth to +3-4%, with core brands expected to grow at more than 4%. Profit growth is expected to grow faster than sales. Reckitt is slimming its portfolio down to grow faster. In July, the company confirmed the sale of its Essential Home business, and management are planning to exit Infant Nutrition, once US litigation is further advanced. The remaining Reckitt portfolio (‘Core Reckitt’) is a focused and attractive list of health and hygiene brands, with the following brands representing more than three quarters of revenue: Mucinex, Strepsils, Gaviscon, Nurofen, Lysol, Dettol, Harpic, Finish, Vanish, Durex and Veet. These brands have grown at a mid-single-digit rate over the long-term, and their prospects look similarly attractive. Reckitt trades on a P/E multiple of 16x for this year, and 15x for next year, whilst the dividend yield of just under 4% is very well supported by the company’s strong free cash flow generation. Management announced another £1bn share buy-back with results, representing more than 2.5% of shares in issue.

Diploma is a value-added distributer which last month reported organic growth of +10% for the first nine months of its financial year and expects a similar rate of growth for the full year, with solid growth across a variety of its end market, including aerospace, defence, life sciences and energy.

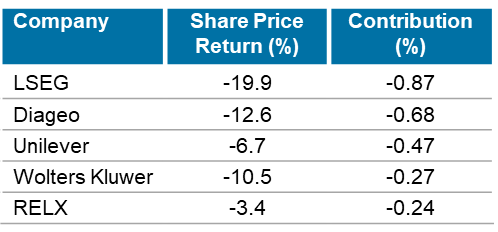

Bottom contributors

Total Return, GBP terms. Source: Bloomberg.

The most negative contributors to return during the quarter were LSEG, Unilever, Diageo, Wolters Kluwer and RELX.

Unilever and Diageo

The global consumer, and particularly the US consumer, has been under pressure over the last two years. Various factors have played their part - a sharp rise in interest rates, a rise in living costs, and the end to Covid-era fiscal stimulus - with younger and low-income consumers hit particularly hard. Along with these pressures, a backdrop of tariff uncertainty has added another layer of consumer caution.

A healing process is now underway, with real wage growth (in both the US and the UK and Europe) turning positive and interest rates beginning to fall. The fall in US interest rates, though, has been slower than one might usually expect, given the level of consumer weakness for two reasons. The first has been the huge stimulus that the AI investment boom has provided to the US economy. This echoes the late 1990s - when massive spend on internet capacity expansion held the Federal Reserve back from reducing interest rates - up until business investment finally fell into recession from 2000 and a period of sharp rate cuts began, providing relief to the consumer economy. The second factor keeping rates high has been tariff uncertainty, with the Federal Reserve taking a go-slow approach on rate reductions, until a clearer picture of tariff impact begins to emerge.

Unilever

Unilever is gaining market share, and despite the tough consumer backdrop the company grew its organic sales by +3.4% in the first half. It is guiding to between +3-5% growth for the rest of the year, with an acceleration in key geographies such as India expected. Profit growth is expected at a higher rate than revenue. We think there is much to like about the reinvestment levels that Unilever’s management are ploughing back into the business to drive growth. Investment in brand equity as a percentage of sales is running at multi-year highs. We also like management’s increasingly focused approach - both on its 24 key geographies, and also on its 30 ‘Power Brands’. These Power Brands (Dove, Rexona, Lifebuoy etc.) now make up more than 75% of group sales, are highly profitable, and are growing ahead of average group growth. Over the medium-term, and following the spin-off of its ice cream division, management expect mid-single-digit revenue growth with a balance between volume and price. For a steady cash generator, and one of the world’s great portfolios of brands, we think the current valuation is very modest. Stripping out the company’s shareholdings in Hindustan Unilever and Unilever Indonesia, the rest of the business is trading on a P/E multiple of less than 14x. The group’s dividend yield is 3.5%, backed by a FCF yield of 5.8%. As an aside, it is worth noting how many so-called ‘old economy’ companies like Unilever are now very sophisticated digital businesses. To use one example, Unilever is in the process of upping its social media spend as a percentage of total media from 30% to 50%, leveraging AI technology and upping its content creation by 20x. There are 19,000 post codes in India and 5,746 municipalities in Brazil, for instance, and CEO Fernando Fernandez is aiming for at least 1 - and up to 100 - influencers in each of these regions. This big step-up in social media reflects the simple fact that this investment generates a higher return on investment than any other use of marketing funds.

Diageo

Diageo has faced a challenging backdrop since late 2022, with the global spirits sector in a post-Covid hangover period, and the holding has been the biggest drag on Evenlode Income’s performance over the last three years. Full-year results and guidance reassured though, with analyst forecasts upgraded for the current year. For the full-year to June 2025, organic revenue rose +1.7% and operating profit fell -0.7%. The company is guiding to low-single-digit revenue growth for the current financial year, and a step-up in profitability as efficiency gains begin to flow through. This guidance assumes no improvement in end markets - management are focusing on what they can control. Diageo is a great British company with an impossible-to-replicate portfolio of brands with authenticity and heritage. Given Diageo’s qualities, any sense that end markets are beginning to improve in coming months could, we think, lead to a significant recovery in sentiment towards the company. In the meantime, FCF delivery was good in the year just finished, and management have set achievable targets for continued FCF delivery (growth of more than +10% for the current year - to $3bn - and rising from there). This FCF underpins a dividend yield of just under 4%.

LSEG, Wolters Kluwer and RELX

The software, data analytics and information services holdings in the fund continue to produce positive results, with continued structural growth in demand for their proprietary data and digital services. For RELX, Experian, LSEG, Sage and Wolters Kluwer, organic revenue for the latest period grew at +7%, +8%, +8%, +9% and +5% respectively. The RELX, LSEG and Wolters updates were interim results, and they posted +10%, +20% and 14% earnings per share growth respectively.

Though never complacent, we think that the competitive positions of these companies remain very good, notwithstanding the arrival of generative AI. All these business models are different and serve different end markets. To generalise though, key competitive advantages include deep customer embeddedness and high switching costs, network effects, proprietary (and often contributory) data, and a commitment to stay close to clients and relentlessly plough-back investment into innovating and developing new products.

All these companies have been investing in machine learning and AI technologies for many years and embedding them in their product offerings. RELX summed this approach up well at recent interim results:

Our improving long-term growth trajectory continues to be driven across the group by the ongoing shift in business mix towards higher growth analytics and decision tools that deliver enhanced value to our customers. We develop and deploy these tools across the company by leveraging deep customer understanding to combine leading content and data sets with powerful artificial intelligence and other technologies. This has been a key driver of the evolution of our business for well over a decade and will remain a key driver of customer value and growth in our business for many years to come.

We had been trimming exposure in some of these names for relative valuation reasons, but the recent underperformance of share prices has begun to improve valuations again. The current FCFY’s of these businesses range from 3.5% in the case of RELX, to 4.7% for Sage and 6.1% for LSEG, and growth prospects are good.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

13 August 2025

Evenlode has developed a Glossary to assist investors to better understand commonly used terms.

Please note, these views represent the opinions of the Evenlode Team as of 13 August 2025 and do not constitute investment advice. Where opinions are expressed, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for illustrative purposes only and should not be relied upon as a recommendation to buy or sell securities. For full information on fund risks and costs and charges, please refer to the Key Investor Documents, Annual & Interim Reports and the Prospectus, which are available on the Evenlode Investment Management website (https://evenlodeinvestment.com). Recent performance information is also shown on factsheets, also available on the website. Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Fund performance figures are shown inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Current forecasts provided for transparency purposes, are subject to change and are not guaranteed.

Footnotes

-

Source: Financial Express, 2nd May 2025 to 31st July 2025, Total Return in GBP.

-

Source: Evenlode, Visible Alpha, Company Reports. Weighted average calculated for Evenlode portfolio. Revenue and profit numbers are organic (excluding impact of foreign exchange and mergers/ acquisitions). Earnings per share is also quoted on an adjusted constant currency basis to give clearer picture of underlying profitability.

-

Free Cash Flow (FCF) - A measure of how much cash a company can generate over and above normal operating expenses and capital expenditure. The more FCF a company has, the more it can allocate to dividend payments and growth opportunities. FCF yield (FCFY) is FCF per share divided by the current share price. A higher FCFY implies a company is generating more cash that could be paid out as dividends and to reinvest into growth of the business. The FCFY of a portfolio is the total free cash flow generated by the portfolio, divided by the market value of the companies in the portfolio.

-

Price/Earnings (P/E) Ratio - A measure of a company’s current market valuation compared to its earning potential, calculated by dividing a company’s share price by its Earnings per share (EPS). EPS is calculated by dividing a company’s profit by the number of shares in issue.