October was another positive month for global stock markets. The prolonged US government shutdown and issues in private debt markets were not enough to suppress investor excitement towards the AI investment boom. Closer to home, ahead of the autumn statement, sentiment towards the UK political environment and economy remains weak.

During October, Evenlode Income rose +4.2% compared to a rise of +3.2% for the IA UK All Companies sector and +3.7% for the FTSE All-Share. This took the year-to-date return for Evenlode Income to +5.0% compared to +14.6% for the IA UK All Companies sector and +20.9% for the FTSE All-Sharei.

An extreme, polarised market

Though aggregate portfolio fundamentals have progressed steadily this year, and at a similar organic rate to the forecast at the start of the year, the share prices of Evenlode Income's holdings have been left far behind global and UK benchmark returns in 2025 - stuck between the AI infrastructure trade that has come to dominate the global index on the one hand, and asset-intensive cyclical stocks such as banks and miners within the UK market context, on the other.

It is hard to overemphasise how unusually polarised market trends have been this year. In the US, the S&P 500 is up +17.2% (or +11.7% in GBP terms)ii, but the equally weighted index has only returned +8.4% (or +3.3% in GBP terms). Index returns have mainly been driven by a handful of technology, industrial and utility companies with exposure to the build-out of huge AI hyperscale data facilities.

In the UK, more than two-thirds of the FTSE All-Share’s return has come from three key areas this year, which the fund does not have exposure to - banks/insurers, defence and resources companiesiii. This trend has been running for much longer than just this year. From their Covid lows in 2020, many stocks in these three sectors have now quadrupled, quintupled or more.

Staying the course

In danger of sounding like a stuck record, we continue to prioritise a diverse collection of high-quality businesses that enjoy strong competitive advantages, healthy cash generation and low levels of both debt and total leverage. A significant portion of the portfolio is invested in repeat-purchase business models. These are qualities that have been underappreciated in recent years, but we are sure will become appreciated again.

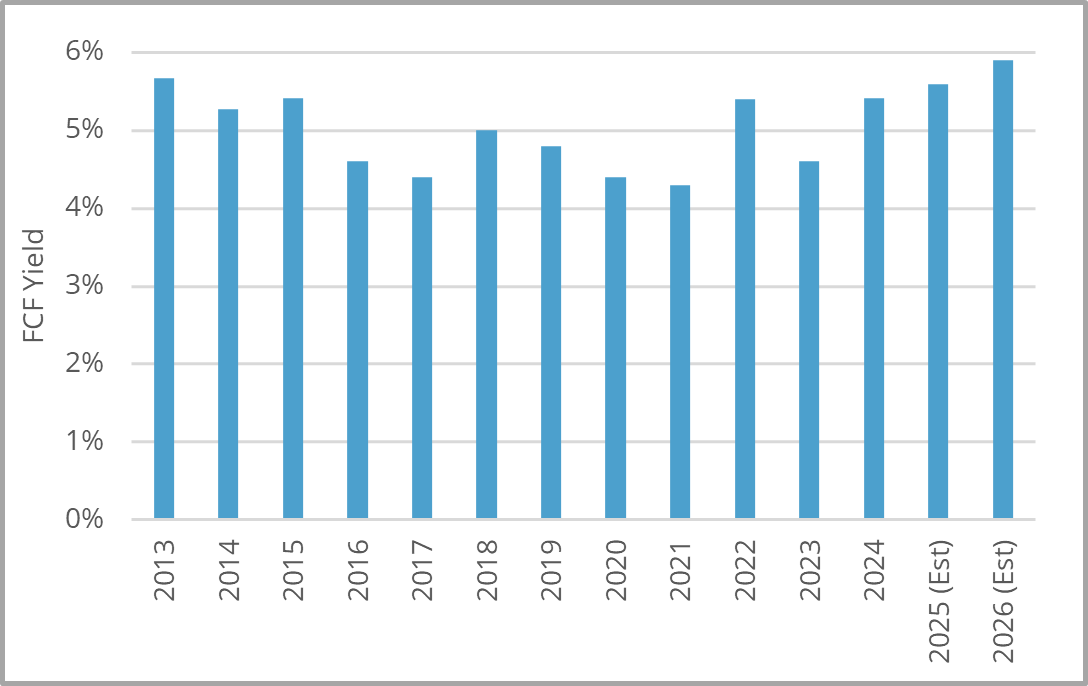

In the meantime, the free cash flow yieldiv of the fund is at the top end of the long-term range seen in Evenlode Income, reminiscent of the relative valuation opportunity we saw in the early days of the fund, and providing a margin of safety that we like.

Evenlode Income free cash flow yield over time

Source: Evenlode.

Shades of the late 1990s

Every stock market cycle is unique, but with generative-AI euphoria in full swing it is hard to ignore the parallels at play today with previous technology capital investment booms – not least the Technology, Media and Communications (TMT) boom of the late 1990s.

In 1998 and 1999 shares of ‘old economy’ stocks significantly underperformed these ‘new era’ TMT companies. Old economy stocks were shunned partly because it was professionally so painful to be underweight the TMT sectors, and partly because investors worried that these old economy companies might be disrupted by the new wave of technology. The internet did prove to be transformational - it genuinely changed the world - but high valuations, a fall-off in capital investment and a shifting competitive landscape led to years of underperformance for most TMT stocks. Meanwhile, the ‘old’ economy did not disappear. Though the internet did prove a disruptive force in some sectors, most market-leading businesses remained highly relevant to their customers, and were able to harness internet technology within their existing business models.

The following two charts show how ‘old economy’ consumer brands Unilever, Diageo and Reckitt performed in the run up to the Nasdaq peak in March 2000, and then in the subsequent TMT sell-off. Please note I am not predicting that the Nasdaq is about to fall -82%! What I am highlighting here is the broad cycle of sentiment towards old economy stocks as the technology investment boom of the 1990s played out.

Moats in the salev

In the current generative-AI boom, digital analytics companies have been added to the ‘old economy’ list over recent months, as investors worry over the potential disruptive impact of the new wave of technology on their businesses. RELX, LSEG and Experian, for instance, have been three of the most significant detractors to Evenlode Income's performance over the last six months.

Though never complacent, we think the competitive positions of these companies remain very good. They are different to each other and serve different end markets. To generalise though, key competitive advantages include deep customer embeddedness and high switching costs, network effects, proprietary (and often contributory) data, and a commitment to stay close to clients and relentlessly plough-back investment into innovating and developing new products – including generative AI technology.

You wouldn’t know it if you looked at recent share price charts, but all three have updated the market with strong trading updates over the last month.

RELX reported organic revenue growthvi of +7% for the first nine months of the year, and reiterated guidance. The company continues to expect revenue growth to accelerate over time as the company’s investments in new functionality – including generative AI and agentic AIvii functionality – continue to bear fruit. Within its legal division, revenue from corporate law firms is now growing at more than +10% thanks to its Lexis Plus AI and Protégé AI solutions. In the Scientific, Technical and Medical division, management are confident that the launch of its new Science Direct AI product will, alongside other new product launches, also help this division to accelerate growth over time.

LSEG reported third quarter organic revenue growth of +6.4% and raised profit guidance for the year. LSEG’s valuation is at decade lows, as the market seems to be inferring that the whole of its data and analytics revenue – which forms approximately 40% of group revenue – is under threat from generative AI. We view the vast bulk of this revenue as very well protected from disruption risk. LSEG’s data:

- Forms one of the world’s most comprehensive libraries of financial and market data, with decades of history. Much of this is proprietary, including contributions from over 40,000 customers. The company owns more than 33 petabytesviii of data – three times more than ‘the common crawl’ (the dataset formed by the public internet, which is used to train many Large Language Models).

- Is primarily used for core real-time pricing data in highly sensitive trading environments. As LSEG put it, they are ‘providing millions of hard facts per second, not probabilistic algorithms. In a nutshell, AI cannot replicate or replace our real-time data’.

- Is provided in a clean, connected and consistent way - including the use of LSEG’s industry-standard RICs identification system.

Along with the quality and scale of its datasets, LSEG is also a trusted and highly integrated partner for clients that operate in highly regulated environments. This adds to the high switching costs. Simpler use cases of front-end desktop software that may be more exposed to competition (vs more complex workflows like trading) are a minor part of LSEG’s group revenue. In this area, it is interesting to note the partnership LSEG announced this month with Anthropic, for use of its data within Anthropic’s Claudeix offering. This is a reminder of the irreplicable nature of LSEG’s data. Users will only be able to access LSEG’s data from within Claude if they have a commercial licence with LSEG. As well as partnering with generative AI offerings, LSEG are also investing in their own generative AI offerings and embedding them in their desktop solutions.

Experian is a global market leader in credit analytics, and in possession of a vast array of proprietary data. CEO Brian Cassin summed this point up well at recent results: ‘these data sets are vast, complex, they're constantly being refreshed, they are subject to expansive and stringent regulation, and they need to be accurate all the time. The job of creating these data assets is a huge and complex operational exercise, which relies not just on process, but also on proprietary intellectual property and significant industry expertise. They simply cannot be replicated and they cannot be accessed unless permissioned by us’.

The company released interim results last week, posting organic revenue growth of +8%, total revenue growth of +12% and earnings per share growth of +13%. Management also upgraded profit guidance for the full year. The company continues to invest heavily in innovative data analytics services, and management are confident this will lead to a gradual acceleration of growth over time. This is how CEO Cassin framed Experian’s growth outlook: ‘…our strategy has always been not only to sell data, but to build solutions on top of our data that provide action and insight to improve client outcomes and reduce costs. Almost all these solutions require our data as a foundational input, and this is a source of huge competitive advantage to us that will grow over time… The excitement for us is that AI will accelerate the speed with which we can bring disruptive new products to market. Our data, our products, our platforms, our product development capability, and our industry footprint gives us a strategic position that most companies would kill for, and we intend to leverage that to accelerate our growth’.

All three of the above companies offer a starting free cash flow yield of more than 4% (significantly more in the case of LSEG), representing run-of-the-mill valuations for exceptional businesses. They are all currently buying back shares too - strong cash generation allows them to both invest meaningfully back into the business, whilst also retiring shares at good prices.

Coda - Howden Joinery

In next month’s view we will give a fuller round up of recent themes from across the portfolio. Before signing off this month though, fresh back from a company visit to Yorkshire, it is worth briefly mentioning Howdens as another great-but-currently-out-of-fashion business operating in a very different world to the digital analytics companies discussed above.

Howden has a unique model, selling its kitchen and joinery products through its local depot network to the UK’s trade builders, and with an in-stock model delivered through its very well-invested vertically integrated manufacturing and supply chain facilities. Depot managers are thoughtfully incentivised and then given a large amount of autonomy to deliver within clear financial guardrails. Howden’s gross margins of more than 60% are testament to this model. This network of factors creates a large competitive advantage over peers. The company has been gradually taking share – now accounting for roughly a quarter of the UK kitchen market, and Howden also continues to expand into other areas of the wider joinery market.

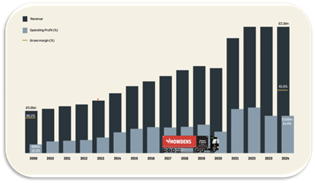

Despite kitchen volumes being very depressed at present (lower than even the 2008-2009 period), Howden’s financial results have been impressively resilient over recent years, as shown in the following chart.

This year, despite volumes remaining tough and costs rising - due to the wage-roll impact of changes at last year’s autumn statement - strong execution and share gains mean the company is set to grow revenue and profit this year. When volumes begin to recover, there is no competitor that is nearly as well placed to capture the upside as Howden – many peers are in financial difficulty and closing stores. In any sort of recovery, Howden’s cash generation would quickly grow from the already healthy level.

In the current global stock market – extreme and polarised as it is – it is worth remembering that shares are stakes in actual companies (not just baskets of financial tokens for hedge fund and ETF investors to buy and sell) and that stakes in good businesses – like RELX, LSEG, Experian and Howden - are well set to create value for shareholders over coming years.

We look forward to updating you further on the Evenlode Income portfolio over coming weeks and months.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

17 November 2025

Evenlode has developed a Glossary to assist investors to better understand commonly used terms. This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for information purposes only and should not be relied upon as a recommendation to buy or sell securities. Prospective investors should seek independent financial advice.

This document has been produced by Evenlode Investment Management Limited (‘Evenlode’). Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given.

Investment commentary represents the opinions of the Evenlode team at the time of writing and does not constitute investment advice. Where opinions are expressed, they are based on current market conditions, may differ from those of other investment professionals and are subject to change without notice. Any forecasts provided are subject to change and are not guaranteed.

IFSL Evenlode Income is a sub-fund of the IFSL Evenlode Investment Funds ICVC. Full details of the Evenlode Funds, including risk warnings, are published in the IFSL Evenlode Investment Funds Prospectus and the IFSL Evenlode Investment Funds Key Investor Information Documents (KIIDs) which are available on request and at www.evenlodeinvestment.com.

The IFSL Evenlode Investment Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. You should therefore regard your investment as long term. As a focused portfolio of between 30 and 50 investments, IFSL Evenlode Income may carry more risk than a fund spread over a larger number of stocks. The funds have the ability to invest in derivatives for the purposes of efficient portfolio management (techniques used by investment managers to manage a portfolio in a way that aims to improve returns, reduce risk, or manage costs, without significantly changing the overall investment strategy or risk profile), which may restrict gains in a rising market. Investments in overseas equities may be affected by changes in exchange rates, which could cause the value of your investment to increase or diminish.

Past financial performance is not a reliable indicator of future results. Fund performance figures are shown inclusive of any reinvested income and net of ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Tax treatment depends on individual circumstances and may change in the future.

Market data is sourced from S&P Capital IQ, Financial Express Analytics and Bloomberg unless otherwise stated.

Evenlode believes that delivering real, durable returns over the long term can be best achieved by integrating environmental, social and governance (ESG) factors into the risk management framework as this ensures that all long-term risks are monitored and managed on an ongoing basis. In addition to reviewing ESG factors when making investment decisions, Evenlode engages with portfolio companies on a range of ESG issues (for example greenhouse gas emission reduction). However, please note that the fund does not have a sustainability objective.

This document is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The sale of shares of the fund may be restricted in certain jurisdictions. In particular shares may not be offered or sold, directly or indirectly in the United States or to U.S. Persons, as is more fully described in the Fund's Prospectus.

FTSE® is a trademark of the relevant London Stock Exchange Group plc (“LSE Group”) companies and is used under licence. FTSE Russell is a trading name of certain LSE Group companies. All rights in FTSE Russell indices and data vest in the relevant LSE Group company. Neither LSE Group nor its licensors accept any liability for errors or omissions in the indices or data, and no reliance should be placed on this information. Redistribution of LSE Group data is prohibited without prior written consent. LSE Group does not promote, sponsor, or endorse the content of this communication.

Evenlode is a trading brand of Evenlode Investment Management Limited. Authorised and regulated by the Financial Conduct Authority, No. 767844. Investment Fund Services Limited (IFSL) is authorised and regulated by the Financial Conduct Authority, No. 464193.

Footnotes

-

Source – Financial Express. Year to date performance 31 December 2024 to 31 October 2025. Bid to bid, Total return basis, GBP Terms. IFSL Evenlode Income B Acc Shares.

-

Source – Financial Express. 31 December 2024 to 31 October 2025.

-

Source – Bloomberg. 31 December 2024 to 31 October 2025.

-

Free cash flow (FCF) is a measure of how much cash a company can generate over and above normal operating expenses and capital expenditure. The more FCF a company has, the more it can allocate to dividend payments and growth opportunities. FCF yield is FCF per share divided by the current share price. A higher Free Cash Flow Yield implies a company is generating more cash that could be paid out as dividends and to reinvest into growth of the business. The Free Cash Flow Yield for the fund is calculated based on the FCF yield for the companies in the portfolio.

-

Moats in the sale – Companies with a strong economic moat (a durable competitive advantage allowing a company to earn excess returns on capital) which are trading at attractive valuations.

-

Organic revenue growth - Excludes growth attributable to mergers and acquisitions and foreign exchange.

-

Agentic AI – AI systems designed to operate autonomously.

-

1 petabyte = 1,125,899,906,842,624 bytes, and could store approximately 200,000 high-definition movies or 210 million songs.

-

Anthropic is an AI company and Claude is an AI assistant it has developed which is trained with a focus on safety and transparency.