Over the last few weeks, global stock markets continued their recovery from the early April sell-off. Though geopolitical uncertainty remains high, sentiment was helped by the agreement between the US and China to mutually reduce tariffs by 115%. This leaves overall US tariffs on Chinese goods at just over 50%, and Chinese tariffs on US goods at just over 30%i. Meanwhile, though confidence indices in the US remained weak, the hard economic data remained more robust than feared. Closer to home, UK economic data was also reasonable, and the Bank of England cut interest rates to 4.25%.

So far this year, Evenlode Income has risen +2.4% compared to a rise of +7.4% for the IA UK All Companies sector and 10.1% for the FTSE All-Shareii.

The fund’s relative performance has clearly lagged the UK market index, and we have discussed the reasons why in recent views. The strategy’s lack of exposure to banks/insurers and defence companies has been a significant drag, accounting for approximately two thirds of underperformance. The other main factor has been the share price weakness in two of the fund’s larger holdings – Bunzl (-26%) and Diageo (-19%). More generally, the fund’s bias towards multinationals has been a performance headwind this year relative to the UK market, thanks to tariff and geopolitical uncertainty and the strength of the pound - particularly versus the dollar.

Looking ahead, though, we feel quietly positive on the outlook. The competitively advantaged businesses that make up the portfolio continue to generate very healthy levels of cash, are forecast to post solid aggregate organic profit growth this year and offer durable appeal. Valuations are also modest, with several portfolio holdings trading at or near multi-year valuation lows.

Spectris approach

In relation to this theme, the Evenlode Income holding Spectris announced a takeover approach from US private equity firm Advent this week. After a number of earlier approaches, Advent proposed an offer representing +85% premium to the undisturbed share price and values the company at £3.7bn.

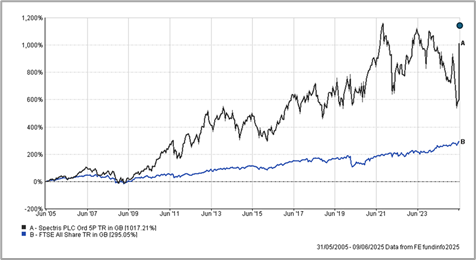

Spectris has been a holding in the Evenlode Income fund for more than a decade. As the below chart shows, the company has compounded at a good rate over time, with a total return of more than 1,000% over the last 20 years (approximately +12.8% per annum). The dot in the top-right corner highlights the offer level.

The company is a leading supplier of precision measurement and instrumentation equipment, with market leading positions in global niches and end markets including life sciences, aerospace and defence, machine manufacturing, semi-conductors, automotive and academic. The group has a reputation for quality, innovation, reliability, and high service levels, all of which lead to strong relationships with customers and high barriers to entry. The company’s Cash Return on Tangible Assets has been stable and consistently high over the long-term, and the company’s pricing power is demonstrated by gross margins of nearly 60%iii.

Spectris has, though, faced challenging markets over the last two years, with some end demand weakness in areas such as automotive and semiconductors, and a post-Covid demand hangover in its life science end markets. Though the company’s medium-term organic revenue growth aspiration is +6-7%, these headwinds led to an organic salesiv decline of -7% in 2024. Analysts currently expect roughly flat organic sales for 2025. The company also took on some debt last summer to make three acquisitions in its Scientific division – an unfortunately timed move in hindsight. Though the company is confident that the direct impact of tariffs will be minimal, ‘Liberation Day’ uncertainty has also not helped sentiment, and may have delayed some customer orders in the second quarter. As a result, prior to the bid emerging, Spectris shares were trading on an unusually depressed Price-to-Earnings (PE)v multiple of 13x current year earnings, compared to an average PE multiple of 17x over the last decade. For context, the bid values the company at a PE multiple of 24x.

We are in contact with the company via their advisers, and will continue to engage, if and when a firm bid materialises.

Embedded value in UK-listed quality

Whatever happens in relation to this Spectris offer, it is a reminder of the embedded value that we see in a diverse range of UK-listed quality businesses. Though many have been out of fashion over the last couple of years, we think the opportunity for the patient investor is compelling.

To add some colour to this point, let’s continue on the theme of high-quality industrial franchises. Three other engineering businesses held in the fund include Smiths Group, Spirax-Sarco and Rotork.

Smiths Group

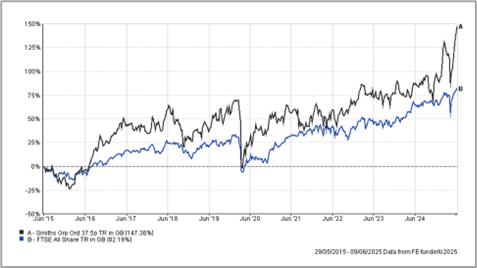

As the chart below demonstrates, Smiths Group has been making good progress in unlocking value for shareholders over the last few years.

The company has raised investment levels, helping drive a pick-up in organic revenue growth. Growth prospects are also supported by growing investment in areas such as energy security, energy efficiency, infrastructure and defence. Year-on-year organic revenue growth for Smiths Group’s most recent quarter was +10.6%. Longer-term, the company’s aspiration is to grow organic revenue at +5-7% and earnings at a double-digit rate. The company also announced the likely disposal of two of its divisions in January, to focus on its John Crane and Flex-Tek divisions which are the most profitable and highest return-on-capital divisions within the group. Smiths Group’s valuation remains attractive, particularly in the context of its growth prospects. The current free cash flow yieldvi is 4.1% and the dividend yieldvii is 2.1%.

Spirax-Sarco and Rotork

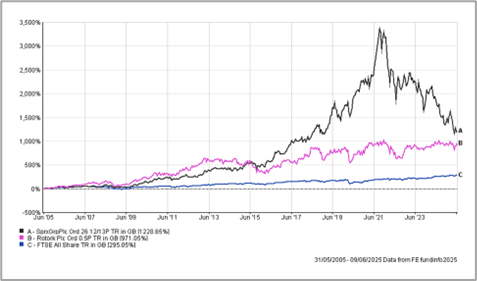

The chart below shows Spirax-Sarco and Rotork’s 20-year total returns versus the FTSE All-Share Index. Rotork has been a long-term holding in the fund - it was added in the early years. Spirax was added towards the end of 2023, and we have added further to the position over the last year. As with Spectris, both companies have compounded at a very good rate over the last 20 years - a +1,229% total return for Spirax and a +971% return for Rotork. Returns, though, have been more disappointing over the last four years.

Spirax’s share price fall since the end of 2021 has mainly been due to a de-rating. Sentiment has been impacted by a slowdown in the industrial end markets that its Steam division operates in, and its Watson Marlow division has suffered from post-Covid destocking trends in life science markets. Rotork’s shares have not so much fallen as gone to sleep for the last four years. The business has been growing at a good rate during this period - revenue was up +4.9% and earnings up +8.7% in 2024, for instance - but the shares have derated. Tariff uncertainty hasn’t helped sentiment recently but as with Spectris, gross margins for both Spirax and Rotork are high (c75% and 50% respectively) and pricing power is strong.

In terms of valuation, Spirax’s dividend yield is now back up to 3% and Rotork’s is 2.6%. Free cash flow generation remains very healthy (free cash flow yields are above 4% for both) and we think the long-term compounding algorithm remains intact for both holdings. Spirax expects organic revenue growth above mid-single-digit over the medium-term, and Rotork expects mid-to-high-single-digit growth on the same basis. These targets are underpinned by the strength of their competitive positions, and - as with Smiths Group - the long-term opportunity driven by rising investment in energy security, energy efficiency, and infrastructure renewal.

New holdings

As mentioned last month, the high level of volatility in the first half of April led us to broaden out the Evenlode Income portfolio. The catalyst for this was the strong share price outperformance of several of the fund’s largest holdings in the initial sell-off, which led us to reduce the number of shares held in order to manage their position sizes. We recycled the cash raised from these trims into five new (or reinitiated) holdings: Rightmove, InterContinental Hotels Group (IHG), L’Oréal, Auto Trader and AstraZeneca. These are high quality, cash generative companies that add interesting diversification and growth potential to the portfolio. They have all been in our investable universe for some time, and in the case of IHG and AstraZeneca we are returning to companies that have previously been long-term holdings within the portfolio. We discussed IHG last month and, as promised, we will finish this month’s investment view by discussing the other four new holdings added in early April.

Rightmove

Rightmove is the UK’s number one property portal, holding over 80% market share and benefitting from a highly cash-generative subscription model. Its strong two-sided network effect - driven by direct consumer traffic and agent reliance - has created significant barriers to entry. Rightmove accounts for more than twice the number of portal-driven instructions as its closest competitor, Zoopla. Their market position is so strong that over 70% of their traffic comes directly through their app, and a further 20% of ‘indirect traffic’ comes from people typing ‘Rightmove’ into Google. A brand that is almost synonymous with what it does is a strong brand.

While the company was historically viewed as being too price-led, it is evolving into a more value-added platform under CEO Johan Svanström, who brings a strong technology background and a military focus on product innovation. Roughly 60% of the 14% headcount increase in 2024 was in technology roles, supporting enhanced tools for Rightmove’s customers, across areas such as lead management, valuation, and market data. This shift dovetails well with the broader transformation currently underway in the UK property market, as things become increasingly data-led, streamlined, and AI-enabled. Rightmove’s strategic growth areas in commercial real estate, mortgages, and data have all shown remarkable growth, from a small base. With its scale, proprietary data assets, and platform evolution, we believe that Rightmove is well-placed to lead - rather than be caught off-guard by - the next wave of change coming to the UK property market.

L’Oréal

L’Oréal offers a combination of global scale, category leadership, and long-term structural tailwinds. Within the context of the current Evenlode Income portfolio, it also adds interesting diversification to our existing exposure to the consumer staples sector. L’Oréal is the world’s leading cosmetics and beauty specialist, with an exceptional global market share of 15%. Its success is rooted in its broad collection of nearly forty leading brands, ranging from mass-market names like Garnier, to science-based dermo-cosmetics such as CeraVe, and luxury names like Lancôme and Aesop: it’s not all just makeup à la Kardashian, since makeup only represents around a fifth of total sales. L’Oréal has evolved from a tiny hair dye business set up in 1909 on Paris’ Rue d’Alger in the stuffy apartment of the brilliant young scientist, Eugene Schueller, to a global beauty leader, spanning more than 150 markets. Following on in Schueller’s scientific spirit, today the company’s R&D capabilities are unmatched in the sector, employing over 4,000 scientists across 21 global sites, with an annual spend exceeding €1.3bn.

We are encouraged that demographic and behavioural trends further reinforce the long-term case for L’Oréal. By 2030, there will be 500m more target beauty consumers in emerging markets alone and half of them from India. Meanwhile, rising affluence, the growth in male grooming, and an ageing yet deeply beauty-conscious population are expanding the size and scope of the market. L’Oréal is also excellently positioned across haircare, fragrance, and dermo-cosmetics areas increasingly tied to wholistic wellness. We believe that these tailwinds combined with excellent brand strength, science-led innovation, and global reach, put L’Oréal in a strong position to compound over the long term.

AstraZeneca

AstraZeneca had been a long-standing holding since 2010, and the recent share price weakness, coupled with solid progression in earnings growth, presented an opportunity to reinitiate a position.

AstraZeneca is a global powerhouse in oncologyviii, with blockbuster therapies such as Tagrisso, Enhertu, and Imfinzi driving over $12bn in sales in 2024 and underpinning its leadership in cancer treatment. Over the past 15 years, the company has demonstrated impressive innovation, diversifying its portfolio not only across oncology but also in biopharma and more recently in rare diseases. While a history of successful drug launches and long-term patents provides a strong defensive moat, the real test for any pharmaceutical company is its ability to keep innovating. AstraZeneca continues to impress on this front, with a number of potential blockbuster read-outs expected in coming years. Importantly, our investment thesis is not pinned to any single trial outcome, but rather to AstraZeneca’s consistent ability to drive pipeline innovation. The company reinvests over 20% of its sales into research and development, a sector-leading ratio among peers. The productivity of this investment is clear: AstraZeneca has launched eight new molecular entities (NMEs) since the start of 2024 and remains on track to reach its upgraded target of 20 by 2030 (NMEs are drugs which have an active ingredient that has not been previously included in any approved drug product in any form, so is a good benchmark for pipeline productivity and innovation). The group are targeting total sales of $80bn by 2030, which implies average top-line growth in the mid-to-high single digits and is supported by their strong late-stage pipeline.

Over the last few months, the shares have underperformed due to an investigation in China into alleged illegal drug importation and data privacy breaches. In terms of materiality, China was 12% of 2024 group sales and we have had recent updates to show that both issues appear largely resolved. The Chinese authorities are signalling a maximum potential payment of $15m (less than 0.03% of 2024 sales) and confirmed that AstraZeneca made no illegal gain from the data breach.

More recently, we have also seen uncertainty around potential US tariffs and US policy uncertainty, contributing to the stock’s derating. We think both risks are manageable for the company. On tariffs, for instance, pharmaceuticals were exempt from Trump’s reciprocal rates announced on Liberation Day, but the administration has indicated that duties on medicines may be introduced. On their latest results call, AstraZeneca’s management team struck a confident tone in their ability to manage any new trade barriers, stating that if tariffs were implemented in the range that we’ve seen for other industries, they would still expect to meet their current 2025 guidance. The vast bulk of their medicines sold in the US are made domestically, with only a minority imported from Europe. For the European imports, mitigations are already underway to shift manufacturing to the US. This largely local-to-local manufacturing model and an impressive 80% gross margin structure, positions the company well to weather any future policy changes. Overall, we view AstraZeneca as a well-invested, diversified, and cash-generative business with good growth potential.

Auto Trader

Auto Trader enjoys highly attractive fundamentals. Its strong economic moat is underpinned by a dominant network effectix, having established itself as the leading platform for used car buyers. Over 75% of all time spent on automotive classified sites in the UK occurs on Auto Trader. Consequently, 90% of UK car dealers list their stock on the platform, ensuring maximum exposure. This delivers significant value, with dealers typically achieving an 8x return on investment, as no other marketing channel can match the volume of leads generated by Auto Trader. This makes the platform exceptionally sticky. As more of the car-buying journey moves online, Auto Trader continues to strengthen its position by providing dealers with digital tools to facilitate sales, thus becoming an increasingly important part of the value chain.

Recent product launches include CoDriver, which automates the writing of vehicle adverts using Auto Trader’s comprehensive taxonomy data, ensuring accuracy and efficiency. The introduction of DealBuilder enables online reservations, part-exchange, finance, and delivery (where offered by the retailer) to be booked online. These innovations allow Auto Trader to expand its share of wallet with dealers and further monetise the value of vehicles sold through its platform.

The business has a strong track record, with organic revenue growth averaging high single digits since its IPOx in 2015, consistently high returns on capital, and very low capital intensity. Operating margins of 70% enable Auto Trader to reinvest in the business for future growth, while also maintaining a robust, net neutral balance sheet. At entry, Auto Trader offered us a free cash flow yield of over 4%, supporting a dividend yield of 1.5% that has good potential to grow over time. The company adds interesting diversification to the portfolio and is a welcome complement to our list of UK domestic holdings.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

12 June 2025

Evenlode has developed a Glossary to assist investors to better understand commonly used terms.

Please note, these views represent the opinions of the Evenlode Team as of 12 June 2025 and do not constitute investment advice. Where opinions are expressed, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for illustrative purposes only and should not be relied upon as a recommendation to buy or sell securities. For full information on fund risks and costs and charges, please refer to the Key Investor Information Documents, Annual & Interim Reports and the Prospectus, which are available on the Evenlode Investment Management website (https://evenlodeinvestment.com). Recent performance information is also shown on factsheets, also available on the website. Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Fund performance figures are shown inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Current forecasts provided for transparency purposes, are subject to change and are not guaranteed. Source: Evenlode Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 767844.

Market data is from S&P CapIQ, Bloomberg and FE Analytics unless otherwise stated.

iSource: Peterson Institute for International Economics, updated 14 May 2025.

iiSource: Evenlode, Financial Express, total return, bid-to-bid, GBP terms. Performance from 31 December 2024 to 12 June 2025.

iiiGross margin - The percentage of money a company keeps from its sales after paying for the direct costs of making or buying the products it sells and before paying for other expenses like rent, salaries, or marketing. It shows how efficiently a company is producing or sourcing its goods.

ivOrganic sales exclude impact of mergers and acquisitions and foreign exchange.

vPrice/Earnings ratio - A measure of a company’s current market valuation compared to its earning potential, calculated by dividing a company’s share price by its Earnings per share (EPS - A measure of company profitability, calculated by dividing a company’s profit by the number of shares in issue).

viFree Cash Flow (FCF) - A measure of how much cash a company can generate over and above normal operating expenses and capital expenditure. The more FCF a company has, the more it can allocate to dividend payments and growth opportunities. Free Cash Flow Yield is FCF per share divided by the current share price. A higher Free Cash Flow Yield implies a company is generating more cash that could be paid out as dividends and to reinvest into growth of the business.

viiDividend Yield - Calculated by dividing the dividend per share by the current share price.

viiiOncology - A branch of medicine that specialises in the diagnosis and treatment of cancer.

ixNetwork effect - Where the value of a product or service increases when the number of people using it increases.

xAn IPO, or Initial Public Offering - When a private company sells its shares to the public for the first time on a stock exchange. This is how a company becomes ‘public’, allowing everyday investors to buy and sell its stock.