Following a chaotic first quarter for geopolitics and stock markets, things got even more disorderly in early April following Trump’s Liberation Day tariff announcement. The correction in global stock markets, having initially begun in February, has gathered further steam in the aftermath of the announcement.

Stock markets fall – Led by the US

As I write, Evenlode Income has fallen -4.2% so far this year, compared to -4.5% for the IA UK All Companies sector and -1.8% for the FTSE All-Sharei. In recent days the selling has been quite indiscriminate, with stocks marked down across the board.

The US stock market has fallen by more than the UK stock market. The S&P 500 is now down -16.5% in sterling terms since the start of the year, and the technology-biased Nasdaq Composite is down -21.7%, also in sterling terms. The magnitude of the US market fall reflects the rapidity with which sentiment towards the US economy and corporate sector shifted - from extremely positive to very negative in a matter of weeks.

Liberation Day recap

The Liberation Day tariffs were significantly higher than expected. The average import tariff on US goods will – prior to any negotiated discounts – rise to approximately 23%, versus a pre-Liberation Day market consensus of around 15%. This average rate returns tariffs to a level last seen in the early 20th Century and represents a significant realignment of the US’s approach to global trade. The country-by-country announcements included a flat tariff of 20% on imports from all EU countries, and a 54% baseline rate for Chinese imports. The UK escaped relatively lightly – with the 10% minimum rate applied. There was also relief for Mexico and Canada, with no additional tariffs being announced over and above February’s 25% baseline rate, and the existing USMCA exemptions retained.

The economic impact

Leading indicators for the US economy have fallen sharply over the last few weeks, as tariff uncertainty has risen. US consumer sentiment has dipped as worries about higher inflation and a slowing economy grow. For businesses, the issue is as much the willy-nilly implementation of the tariff framework as the absolute amount being levied – with everything still open to negotiation and liable to change. The temptation for CEOs is therefore to press pause for now on major investment and hiring decisions, until a clearer picture emerges. This situation is somewhat reminiscent of the first few days of the pandemic lockdown, when the world collectively held its breath and waited for the next steps to unfold.

US import tariffs will also have an impact on the economies of the US’s key trading partners, including the EU and China – though both regions are embarking on large fiscal packages, which will help offset the tariff impact.

Some other mitigating factors are worth noting. Trump’s tariffs are clearly bad news for US consumers and voters, and so in the teeth of a slowing economy, it is likely that the US administration will find ways to water the initial tariff rates down – particularly as next year’s US mid-term elections will soon be heaving into sight. Interest rates are also now likely to come down more quickly than previously expected. The oil price has fallen sharply this year, a trend that accelerated in the last week – with WTI Crude now down from around $80 per barrel in mid-January to less than $60 per barrel. This, along with a slowing economy, is disinflationary and will give central banks more breathing space for monetary easing.

A new era

We are cognisant of the new era that the world has found itself in, with geopolitical alliances shifting, the US at its most isolationist for more than eighty years, and protectionism and nationalism on the rise. The change is profound.

At the same time, though, quality businesses have a long history of weathering political and economic adversity and can be remarkably adaptable to change. Investment in national economies will also be crucial in coming years with the goal of driving better growth and resilience. Structural trends include the need for investment in digitalisation and automation, research and development, health care, upgraded infrastructure and industrial facilities, and improved energy efficiency and security. Portfolio companies are well placed to meet these needs.

Though times are changing, there is also much about the current phase of stock market upheaval that is familiar. As panic sets in, time horizons shorten and share prices become mesmerizing. The last few days have been reminiscent of the first phase of the Covid sell-off, with across-the-board selling as investors shoot first and ask questions later. More than ever, remaining calm and objective and focusing on the fundamentals of business analysis is crucial. We find our own analysis - as well as the conversations we have with companies, analysts and experts - particularly grounding through such periods.

We are also open to tweaking the sails of the portfolio, to adapt to changing conditions and to take advantage of valuation changes. On this note, we are making some changes at the margin, including initiating some new positions. We will update on portfolio activity in due course.

Quality cash flow

The portfolio is now trading on a historic free cash flow yieldii of more than 6% and a dividend yieldiii of 3.3%. Its bedrock is composed of repeat-purchase holdings, whose cash generation tends to hold up well in times of economic difficulties.

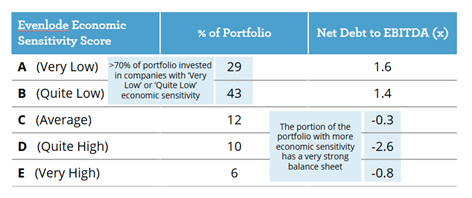

The table below highlights the split of the Evenlode Income portfolio by our economic sensitivity score (with A being the most resilient category, and E being the least resilient).

Source: Evenlode Investment, 31 March 2025iv

As shown, nearly three quarters of the portfolio are invested in less economically sensitive, repeat-purchase businesses (i.e. those that score A or B on our economic sensitivity score). These two categories include a range of holdings, including consumer branded goods, health care, software and specialist support service companies. Last month we discussed the top seven holdings in the portfolio in more detail, which covers a range of these businesses. We continue to think they are well placed to compound per share free cash flow at a good rate over coming years.

Where the fund holds more economically sensitive companies, the focus is on asset-light market leaders that should cope with more challenging trading conditions and emerge in good shape on the other side. As shown in the table above, we like these companies to have particularly strong balance sheets. Four examples are Savills, Howden Joinery, PageGroup and Rotork, all of whom have recently released full year results. These are well managed companies that are leaders in the global real estate consultancy, UK joinery, specialist recruitment and global actuators market respectively. The net cash positions of each company were, at the end of 2024, £176m, £346m, £95m and £125m respectively (Source – company accounts/announcements).

Though we see compelling valuation appeal and long-term potential for these holdings, we always retain the bedrock of cash generation in steadier companies – so these D and E category companies will remain a relatively small portion of the overall cash flow stream.

US import tariffs – A bottom-up view

To finish this view, we will give a little more detail on company-specific considerations for tariffs. As discussed in our October 2024 post-election investment view, there are three broad categories that portfolio holdings fall into:

- No US imports: This category includes companies that generate little or no revenue from the US, and also companies that are selling services rather than ‘stuff’. Digital and data analytical companies, for instance, such as RELX, Experian, LSEG and Sage fall into this category, as do domestically exposed names such as Howden Joinery and Integrafin.

- Limited US imports: Examples in this category include specialist distributors, engineering firms, and health care companies (although most pharmaceutical products are, for now at least, exempt from tariffs). In general, these companies do not import a great deal into the US – they tend to have a predominately local-to-local sourcing and manufacturing footprint. Specialist distributors Bunzl and Diploma, for instance, source more than 80% and 90% of their US sales domestically. Where tariffs have an inflationary impact on input costs, pricing will be used to help offset the impact.

- More significant US imports: The holdings with the more significant US imports are the luxury goods holdings, Games Workshop and Diageo. These companies make up around 10% of the portfolio. We visited Games Workshop in Nottingham last week, and they are relaxed about tariffs. The company import the products they sell in the US from Nottingham. Gross margins on their products are more than 70%, which means that – at the UK’s 10% tariff rate – they will need to raise prices by +3% to protect their profitability. Diageo is potentially exposed to import tariffs via the Tequila, Canadian Whisky and Scotch it imports into the US from Mexico, Canada and the UK. It also imports a small amount of product from the EU. With the Canadian and Mexican USMCA exemptions being retained last week, the new tariffs will only impact Diageo’s imports from the UK and EU – a welcome relief. As with Games Workshop, the high gross margin structure (60% for Diageo) will be helpful in passing these tariff costs on. Analysts expect a small (c3%) impact to company earnings as a result of these new tariffs on the UK and EU.

That’s all for this month. We look forward to keeping you updated through these turbulent times and are as always available if you have any questions.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

4 April 2025

Evenlode has developed a Glossary to assist investors to better understand commonly used terms.

Please note, these views represent the opinions of the Evenlode Team as of 4 April 2025 and do not constitute investment advice. Where opinions are expressed, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for illustrative purposes only and should not be relied upon as a recommendation to buy or sell securities. For full information on fund risks and costs and charges, please refer to the Key Investor Information Documents, Annual & Interim Reports and the Prospectus, which are available on the Evenlode Investment Management website (https://evenlodeinvestment.com). Recent performance information is also shown on factsheets, also available on the website. Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Fund performance figures are shown inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Current forecasts provided for transparency purposes, are subject to change and are not guaranteed. Source: Evenlode Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 767844.

Market data is from S&P CapIQ, Bloomberg and FE Analytics unless otherwise stated.

iSource: Evenlode, Financial Express, total return, bid-to-bid, GBP terms. Performance from 31 December 2024 to 4 April 2025.

iiFree Cash Flow (FCF) - A measure of how much cash a company can generate over and above normal operating expenses and capital expenditure. The more FCF a company has, the more it can allocate to dividend payments and growth opportunities. Free Cash Flow Yield is FCF per share divided by the current share price. A higher Free Cash Flow Yield implies a company is generating more cash that could be paid out as dividends and to reinvest into growth of the business. The Free Cash Flow Yield of a portfolio is the total free cash flow generated, divided by the market value of the companies in the portfolio or index.

iiiDividend Yield - A measure of income from an investment over a period of time. Calculated by dividing the dividend per share by the current share price. The Dividend Yield of a portfolio is calculated based on a weighted average of the dividend yields of companies in the portfolio.

ivEBITDA = Earnings before Interest, Taxes, Depreciation and Amortisation – a measure of a company’s operating performance excluding the effects of financing decisions, taxation and accounting practices. Net Debt is a company’s total debt minus cash and cash equivalents and is a measure of a company’s ability to pay off debt – a lower ratio indicates better financial health. A negative figure means a company has more cash than debt.