Summer 2015 is turning into a difficult period for global stock markets, with the market sell-off this month accelerating in both its magnitude and speed over the last two weeks. As I write the UK market is down more than -15% since its highs earlier in the year, the first correction of this scale since August 2011.

Investor worries have moved on from the Eurozone crisis to concerns over the slowdown in China’s economy and the impact it is having on emerging market economies, commodity prices, and ultimately the impact it might have on developed world economies. Deflation fears are back in the frame and bond yields are falling again as expectations concerning the extent of interest rate hikes in the UK and US diminish. The oil price is back to levels last seen in early 2009.

Staying The Course

Periods of plummeting share prices are inevitable for a long-term investor, and must be endured. However, they are never enjoyable and always fray nerves. We feel it is important to keep our discipline in these market conditions and continue to follow our process.

We remain reassured by the inherently strong cash generative qualities of the aggregate portfolio which supports the dividend flow. Approximately 70% of the portfolio is invested in four key sectors - consumer brands, healthcare, media and software. These businesses are backed by resilient cashflow streams with repeat-purchase and/or subscription characteristics, and have characteristics that are more stable than the volatility in their share prices sometimes suggests.

Consumer Branded Goods

Of the fund's key sectors, consumer branded goods companies have the most sales exposure to emerging markets. Recent results were a reminder that despite tough conditions globally, these businesses enjoy a resilient demand profile (shampoo, soap, toothpaste, beer, cigarettes etc.), pricing power and good levels of cash generation. Unilever, for instance, managed to post underlying sales growth of +6% in emerging markets for the first half of the year, during a period in which GDP growth for emerging markets in aggregate (excluding China) looks not to have grown at all. Several of our positions in this sector also have very good potential for margin progression in my view, thanks partly to falling commodity prices and partly to efficiency improvements.

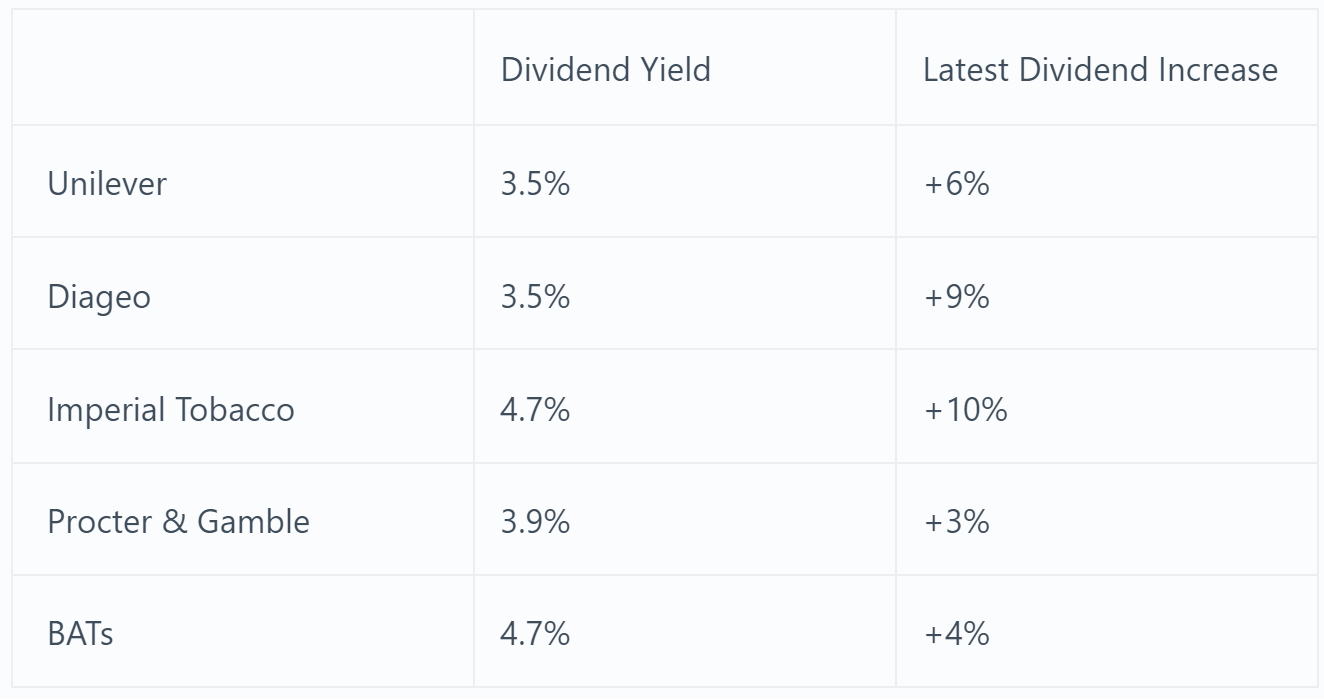

It is true that currency weakness has been a significant drag on reported earnings for these businesses over the last two years, and has slowed the rate of dividend growth in the sector overall. But currency headwinds will ultimately ease and turn to tailwinds, and in the meantime dividends continue to move forward at a reasonable rate. Below are the prospective dividend yields and the most recent dividend increases from our largest positions in this sector*:

Long-term, the opportunity for these companies to grow cash flows and dividends thanks to their geographically spread brand portfolios remains compelling in my view.

More generally, we view global diversification as a positive attribute, notwithstanding the market's recent preference for companies with cyclical gearing into the UK economy. The portfolio does contain several domestic companies, but many of the sectors that our investment approach naturally leads us to are global in scope (consumer brands, media, software, healthcare, niche engineers etc). Geographical expansion presents opportunities for incremental growth and returns over the long-run. We cherish the qualities of these companies and would not want to jettison them based on short-term market trends (which have made many multinational companies look increasingly compelling, in our view).

China and Commodities

Along with emerging markets, worries over a Chinese slowdown have thrust mining and energy stocks into focus over the last few weeks. The Evenlode fund has no exposure to energy and mining producers. This is not a short-term call on the sector but instead is due to our structural bias away from asset-heavy, capital intensive businesses. The current downturn is a reminder of the intense stress that is put on cash generation and dividend flow for these companies in times of adversity.

Evenlode does, however, have some exposure to speciality engineering stocks. The severity of the commodity and energy downturns is placing pressure on those engineers with exposure to these end markets, and it has led us to reassess and stress test Evenlode’s holdings in the sector. As a result, we have removed Weir Group and Amec from the portfolio. We have some concerns over their balance sheets if the very deep downturn currently underway continues for a protracted period. These have been disappointing investments, but we have reinvested the money in other opportunities where we see attractive value, less risk and more potential for dividend growth.

We remain comfortable with the other engineering companies in the fund, which make up c6.5% of the portfolio (Smiths Group, Spectris, IMI and Rotork). In our view these holdings are well placed to weather current challenges and offer considerable value.

Forward Returns Improving

The primary valuation metric we use when valuing companies is our forward cash return measure. This is analogous to looking at shares as a bond investor would (i.e. a higher forward cash return represents better value)**.

The chart below updates the forward return potential we see in both the portfolio and the investable universe as a result of the current market correction:

So valuations have improved significantly and on our estimates look as attractive as we have seen in the last three years or so. We are also reassured by the cash-backed dividend yields and potential for dividend growth from Evenlode companies.

We appreciate your support and interest in the fund and I would reassert a basic belief of ours: time is a friend to investors in the fractional shares of good businesses. But during periods like this, patience is required.

Hugh Yarrow, Investment Director

24 August 2015

Please note, these views represent the personal opinions of Hugh Yarrow as at 24 August 2015 and do not constitute investment advice.

*Source: Canaccord, Evenlode Investment. Percentage increases in reported currency.

**Our forward cash return measure is the discount rate at which our estimate of future cash flows for an individual company is equal to the company's current market value. It is analogous to a bond's redemption yield.