"Remember the power of compounding. You don’t need to stretch for returns to grow your capital over the course of your life".

Walter Schloss

Following a somewhat benign, positive year for stock markets in 2017, the first three months of 2018 have seen a marked change in tone, with February weakness continuing into March. Year-to-date the FTSE Allshare has fallen –6.7% compared to a fall of -3.2% for the Evenlode Income fund (as at 20 March).

Although the economic backdrop has improved a little, worries have centred on a tightening of monetary policy, particularly in the US, which provides a headwind to equity valuations and at the same time raises the question of whether rising rates may ultimately impact a global economy that continues to be burdened with a high stock of debt. Inflation is rising presently, but deflationary risks linger over the medium-term outlook. The recent geopolitical mood-music (threats of trade tariffs from the US, Russian tensions etc.) has not helped this backdrop.

Quality Compounders

Whilst it never feels enjoyable at the time, market corrections are an inevitable part of the long-term investment process, re-injecting value back into the market and reining in sentiment (which, as I discussed in January, had reached quite consensually positive levels at the end of last year). Stock-by-stock volatility tends to pick up too, which can provide opportunities for the portfolio.

We have begun to see a little more value emerge in several high quality franchises this year, which I view as a positive development. This month I would like to briefly discuss four Evenlode Income holdings that we have been deploying new cash into.

These stocks exhibit qualities that I think give an investor the ‘best of both worlds’:

1) A decent free cash flow (FCF) yield and dividend yield today.

2) The financial strength to re-invest in their business models to adapt, evolve and generate steady growth in an ever-changing world.

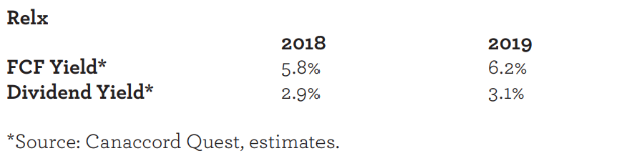

We have increased exposure to RELX significantly over the last few weeks as the valuation has improved. The position is now back to more than 4% of the fund, for the first time in a while. At the turn of the millenium Relx was predominately a print publisher, with only 22% of revenues coming from digital products. Thanks to consistent investment in digital and data analytics products over the last two decades, RELX now generates only 11% of revenues from print formats, with approximately 75% of revenues coming from digital formats (the balance is generated from its face-to-face exhibitions business). This digital business model tends to embed RELX’s products deeply into customer’s workflows, helping to provide steady, recurring cash flows. As RELX continues to plough its furrow of organic growth from data analytics services and decision making tools, returns on capital have steadily increased. Organic sales growth during 2017 was +4% and earnings (which are consistently converted to cash) grew +7%. The company increased its dividend by +10% and given the free cash flow cover the prospects for future dividend growth remain very good.

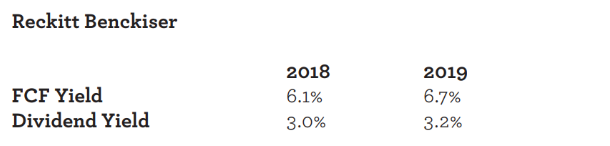

Reckitt had a tough 2017 with several issues holding back the business (a cyber breach, a legacy product issue in Korea, the loss of some key employees etc.). The company also acquired Mead Johnson during the year, an acquisition that will take time to integrate and return to growth, and involved taking some debt onto the balance sheet. These are the negatives.

However, even in adversity, Reckitt continues to generate very strong free cash flow, a sign of the franchise’s quality. And after the recent pull back, Reckitt’s equity now offers a 3% starting dividend yield, a level not seen for some time, and it’s nicely covered by free cash flow. I fully acknowledge short-term issues, but also continue to think that Reckitt has one of the most interesting growth runways of any stock in the UK market over the next couple of decades. This is thanks to structural growth in its key categories (85% of Reckitt’s sales now come from health and hygiene brands, compared to 65% in 2012), a very strong brand portfolio, a well entrenched emerging market footprint, and ongoing investment in growth and innovation.

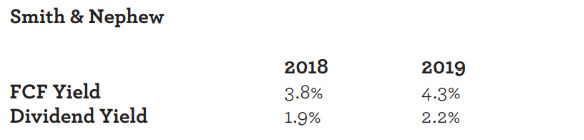

Smith & Nephew was founded in Hull in 1859 and a culture of prudence and long-termism has built up in the organisation over time. Today, the group enjoys strong competitive positions in its key markets of advanced wound management, sports medicine and orthopaedic reconstruction. It quietly minds its own business, sometimes going a bit unnoticed in the FTSE 100. Over the medium-term, the company might well be a takeover candidate for one of the other large medical devices companies, but in many ways I hope this doesn’t happen: its long-term standalone prospects look good. Some of Smith & Nephew’s markets have been challenging over recent years (most notably orthopaedic reconstruction) but the company has continued to grow and the outlook remains promising thanks to demographics, emerging market growth and the opportunity to develop innovative new solutions that help improve both efficiency and patient outcomes. I have been impressed by Smith & Nephew’s attitude to innovation over recent years, and the company is producing some interesting products in areas spanning from negative pressure wound therapy to surgical robotics, which build on their existing brands and distribution networks. We also continue to like the company’s highly cash generative business model and strong balance sheet. The dividend yield is not the highest in the portfolio, but dividend growth prospects are good and the most recent dividend increase was +14%.

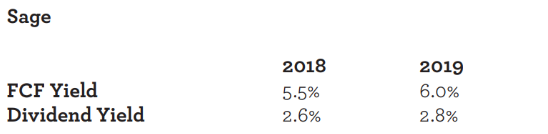

Sage shares have performed poorly this year, falling nearly 20%, and the stock has been one of the most negative contributor’s to Evenlode Income’s return in 2018. However, we viewed recent results as reassuring and the business continues to enjoy an enviable global leadership position in the provision of enterprise software to small and medium sized businesses. This market is structurally attractive and is growing at approximately +7% per annum. Sage has been through an investment phase over recent years, both centralising its business under one core technology platform, and accelerating its investment in new technologies to ensure this competitive position is retained. 78% of Sage’s revenue is recurring and as an increasing number of customers migrate to cloud subscriptions, the company expects recurring revenue to move towards 90% of sales, providing a very resilient bedrock of cash flow. Free cash flow cover on the dividend is excellent and the most recent dividend increase was +9%.

Afterword: Evenlode Income Soft Close

As announced earlier in the month, the Evenlode Income fund will be soft closing on 1May. This follows the discussions we have had with many of you over the last couple of years regarding managing the fund’s growth in assets, and reflects our desire to prioritise and maintain relationships with you, our existing investors, over coming years.

The soft close will have no impact on existing or future investments for Evenlode Income’s existing clients. However, if you do have any queries about it, please do get in touch. And just to confirm, I will continue to write this monthly investment view (for those brave few of you still reading it!) and there is more information about our thoughts and approach in the News & Views section of our website. I and the Evenlode team will remain as available as ever for investor queries, updates etc., and look forward to seeing you in the near future.

Have a very enjoyable Easter.

Hugh Yarrow, Fund Manager

20 March 2018

Please note, these views represent the opinions of Hugh Yarrow as at 20 March 2018 and do not constitute investment advice.