"The stock market is a giant distraction to the business of investing"

Jack Bogle

Review of 2015

In my investment view last January, I mentioned Buffett’s description of the stock market as a ‘drunken psycho’, staggering from one piece of news-flow to another. Market prices certainly staggered up and down a great deal in 2015 (to be more accurate they staggered up, then down, and then up again). The year began positively as the European Central Bank announced a package of quantitative easing whilst US and European economies appeared to be picking up some steam. However, the mood soon turned. Fears over Greece, rising US interest rates, plunging oil and commodity prices and emerging market economies (particularly China) all contributed. In tandem, the list of geopolitical issues has grown (terrorism, refugees, ISIS, the rise of nationalist politics, Brexit etc.).

When all was said and done, 2015 was actually a very similar year to 2014 for the UK market, in the sense that investors had to put up with a high level of volatility, but only received a miniscule total return (+1.0%) for their troubles.

Fund Performance

Evenlode performed relatively well in these tougher conditions, registering a total return of +8.4%. This was not made in a straight line however, with some of our key multinational holdings (particularly within the global branded goods sector) experiencing an unusually high level of share price volatility in the summer months as investors debated valuations and emerging market exposure.

As in 2014, the underperformance of energy and industrial metals stocks was helpful to relative performance (the fund has zero exposure to these sectors). In terms of Evenlode holdings, the strongest contributors to return during 2015 were Imperial Tobacco (+1.8%), Sage (+1.5%), Unilever (+1.2%), Domino Printing (+1.1%), Microsoft (+1.1%) and RWS Holdings (+0.9%). Domino Printing was acquired during the year by Japanese firm Brother.* All the other holdings mentioned above performed well as they reported resilient results and steady dividend growth.

Unilever released final results last week, and serves as a good example of this resilience. The company generates more than 50% of sales from emerging markets and has had to operate with significant volatility in many of its businesses, not least thanks to levels of currency volatility not seen since the Asian crisis of the late 1990s. However, it managed to grow total sales by +4% and earnings by +11%, while generating strong free cash flow and increasing the dividend by 6%.**

A throwaway line from Unilever’s management this week on the results conference call, was also instructive:

If the situation gets tougher we tend to outperform more.

This was made in relation to Unilever’s Indonesian business but it makes a more general point about competition nicely: in difficult times, the strong tend to grow stronger. A quiet strengthening of market position during an industry slowdown doesn’t really show up in short-term numbers, but it's good news for the long-term share holder. It reminds me of the old Wall Street adage – you make your money in a bear market, you just don’t realise it at the time.

The two main detractors to performance were Pearson (-1.4%) and Halfords (-0.8%). Pearson has had a very difficult couple of years. It is pressing on with considerable internal restructuring and integration efforts in the face of operational headwinds, particularly in the US school and college market. At the same time, there remains some uncertainty over the extent to which the adoption of digital products in its markets represents a threat or opportunity. We underestimated the degree of internal integration required at Pearson, and clearly Pearson was a disappointing investment in 2015. We have, however, retained the holding. Pearson’s balance sheet is strong following recent disposals and the business remains an inherently asset light model with a strong market position in Anglo-Saxon education markets. Management are now focusing on getting the most out of Pearson’s existing portfolio, and utilising technology platforms and digitial analytics to deliver better educational outcomes. If Pearson can get this right, the opportunity is clear. Products and services that help students learn better will be valued by society and should therefore command good pricing power.

Halfords’ shares fell after the UK cycling market saw a slowdown following several years of excellent growth. Halfords has been a holding in the past, and we re-initiated a holding for Evenlode during the summer. We particularly like its repeat-purchase car maintenance business (replacing bulbs, batteries, wiper blades etc.), a cash flow stream that has proved resilient over the years. Halford’s balance sheet is in good shape and the c5% dividend yield is supported by healthy free cash generation.

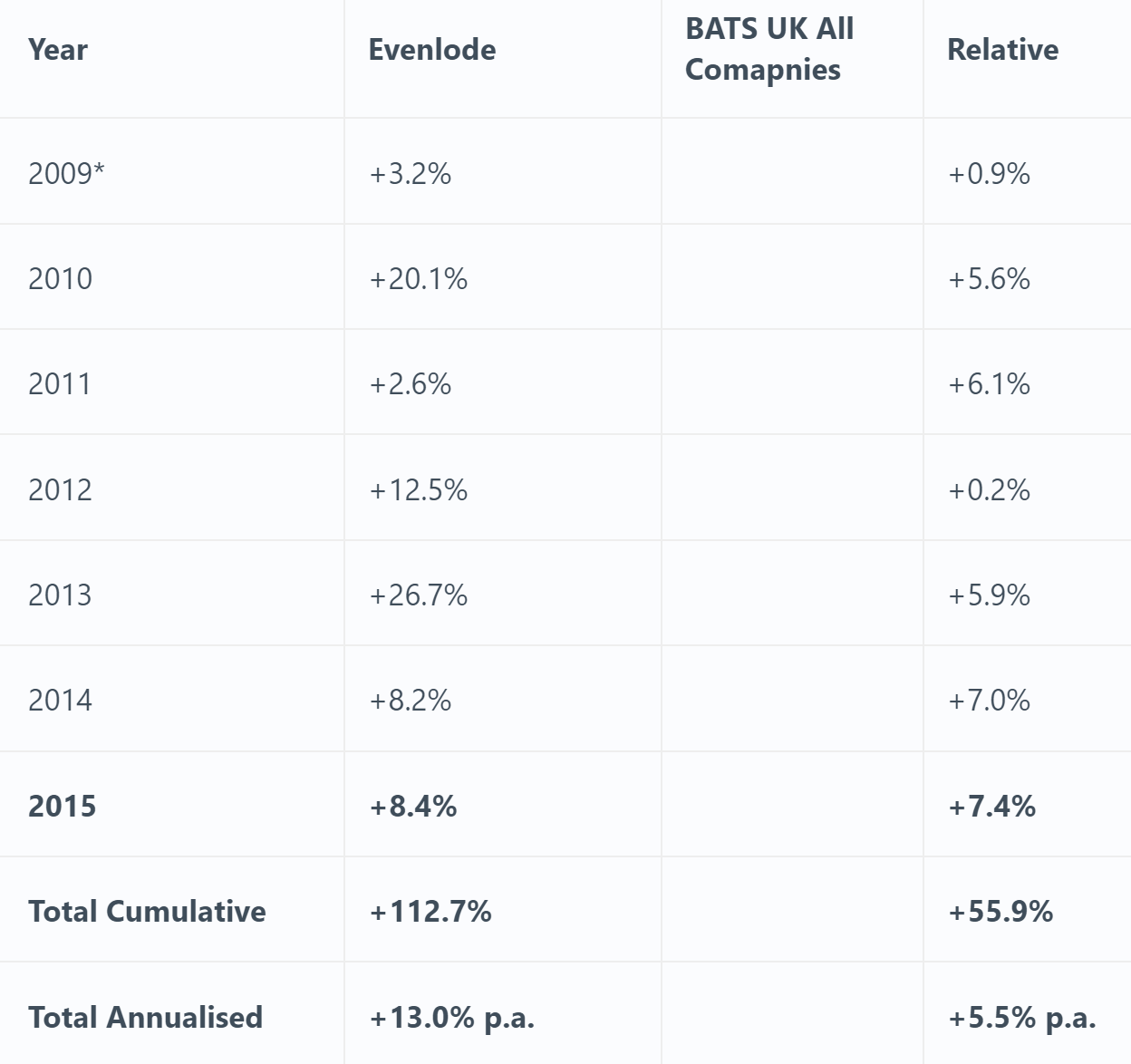

With another year added to Evenlode’s life, below are the results by calendar year versus the fund’s benchmark:

As I have noted before, there is nothing peculiar about our investment strategy that means it will outperform the UK market each and every year. While all the numbers in the last column happen to be positive, this will not always be the case.

Our focus on high quality, asset-light stocks results in a portfolio that looks very different to the UK market. We think this approach is well placed to achieve long-term outperformance while providing a safety buffer against uncertainty. But over shorter time periods, there will be certain markets (for instance, when commodity and banking shares are sharply outperforming) where this is unlikely to be the case. Ben, Chris and I are committed to managing the fund in this way over the very long term.

Dividends

The dividend outlook for the overall UK market is not good. Several large constituents have announced reduced or cancelled dividends (Centrica, Sainsbury, Tesco, Glencore, Anglo American, Standard Chartered etc.) over the last year and there is a risk that dividends in the commodity and energy sector may continue to melt away. At an aggregate market level, dividends may therefore fall quite a bit over the next year or two.

In this context, we feel reassured by the healthy level of free cash flow generated by the aggregate Evenlode portfolio. This supports the dividend flow. We currently expect the full year dividend increase (to February 2016) to be in the low single digits, which reflects reasonable dividend growth from underlying holdings offset somewhat by a tough comparator last year (the fund’s dividend was up more than +12%, helped by a large special dividend from Compass). More generally, our focus on providing real dividend growth over the medium and long-term remains central to our approach. In my view, however, mid-single-digit dividend growth is probably as much as can be expected in the current environment, even from the cash generative businesses we focus on. A higher growth rate is unlikely unless the global economy were to pick up and/or the pound were to weaken against global currencies (thereby providing a tailwind for the fund’s UK listed multinational holdings who make much of their money overseas put pay their dividends in pounds)***.

The Need For Investment

I would also note, in the context of dividend payments, that we much prefer companies that are able to properly invest in their futures as well as paying a healthy dividend. This is part of a wider theme that I have talked about before (e.g. Funding The Future - Evenlode Investment View: May 2015). In the current environment growth is hard to find, and management teams feel the pressure of keeping shareholders happy by returning cash. But businesses need to invest in real things – research capabilities, new product development, geographical expansion, good quality people, technology platforms etc. to ensure a healthy long-term future. Sometimes bad things happen to good companies over the short-term, and it makes sense to adjust dividends. Evenlode has had two holdings reduce dividends in the fund since launch, Hays and Halfords (Hays in 2012, Halfords in 2013). We added to both these shares following the reduction, as we felt it left them in a better position given the circumstances. A failure to invest can compromise a company’s future.****

2016 Outlook

The year has not started well for the stock market. In fact it feels a little like a drunken psycho is once again in charge of proceeding, with levels of individual stock-by-stock volatility also very high.

In terms of the outlook, it is undoubtedly challenging. The global economy continues to suffer from the long shadow cast by the Global Financial Crisis of 2008/9 with trend growth rates low. Meanwhile, having been the ‘sexy’, must-have economies five years ago, investors currently despise emerging markets and emerging market currencies, and the risk they (particularly China) pose to the overall global economy. The UK and US economies look in better shape (or at least they look like the ‘best houses in a bad neighbourhood’) and the sharp fall in the oil price should be positive for consumers in the Anglo-Saxon world.

Disruptive changes also stalk around in the shadows of many mature industries, as developments in online commerce, software analytics (big data, artificial intelligence, the internet of things etc.), biotechnology, solar energy, battery storage etc. continue at a pace. For many mature companies these developments present threats but also interesting opportunities (software, media, healthcare etc.), but for others they present just threats (e.g. Amazon versus traditional retailers). This remains a topic we follow closely and will be something I will discuss in a future investment view (I have discussed it previously too, e.g. On Taking Flak and Remaining Airborne - Evenlode Investment View: April 2014).

Valuations and Risk

As we have being saying for the last three years or so, valuations have not looked particularly attractive for the UK market on aggregate and we’d expect returns available over the next five years to be less attractive than those produced over the previous five years.

Recent market falls have, however, left future return potential looking as good as it has for some time. The primary valuation metric we use when valuing companies is our forward cash return measure. This is analogous to looking at shares as a bond investor would (i.e. a higher forward cash return represents better value)*****.

The chart below updates the forward return potential we see in both the portfolio and the investable universe as a result of the current market correction:

There is a balance to strike in the current market (as always) between value and quality. Stocks that appear cheap on the basis of a low multiple relative to current earnings don’t always equate to tremendously successful investments. For cyclical, leveraged stocks, dividend cancellations and ultimately equity issuance may be required to shore up balance sheets, and this dilution to existing shareholders can result in large capital losses that may never be fully recouped.

But, at the same time, a falling market and stock-by-stock volatility is (and will continue to) serve up opportunities in companies with sound finances and attractive long-term prospects.

I would like to take this opportunity to thank our co-investors for their support over the last year, and wish you the best for 2016. We look forward to updating you over coming months on what is likely to be a challenging but interesting year.

Hugh Yarrow, Investment Director

22 January 2016

Please note, these views represent the personal opinions of Hugh Yarrow as at 22 January 2016 and do not constitute investment advice.

*The fund also benefited from AB Inbev’s agreed takeover offer for SABMiller, which contributed +0.3% to performance.

**Sales and earnings figures before the impact of currency. After currency (in euro terms) Unilever’s 2015 sales increased 10% and Earnings Per Share increased +14%.

***The aggregate regional sales exposure for Evenlode’s underlying holdings has not changed much over the years and is currently approximately as follows: UK 20%, North America 30%, Continental Europe 20%, Rest of The World 30%.

****Two Evenlode holdings in particular, Pearson and Glaxosmithkline, have had ‘bad things’ happen to them over the last couple of years which has resulted in their dividends looking rather high relative to in-year free cash flow. For both stocks we would have supported a reduction in the dividends by management. As it happens, both companies have committed to retaining the dividend, and have used other methods to repair their balance sheet strength while free cash flow cover rebuilds. Glaxo’s management cancelled the share buy back programme and will return only £1bn of the £4bn cash it received from Novartis as a special dividend. In Pearson’s case, approximately £1.4bn of cash has been raised from disposals of the FT, The Economist and Powerschool over the last year.

*****Our forward cash return measure is the discount rate at which our estimate of future cash flows for an individual company is equal to the company’s current market value. It is exactly analogous to a bond's redemption yield.