2014 was not the easiest ride for investors, and when all was said and done the UK market inched out a total return of +1.2%. Evenlode performed relatively well in these tougher conditions, returning +8.2%. As the year progressed, sentiment soured thanks to a slowing global economy and negative geopolitical developments. With this backdrop, investors began to seek out more predictable, resilient businesses, which helped the fund’s performance. The underperformance of commodity producing stocks, to which the fund has no exposure, also helped relative performance in the second half.

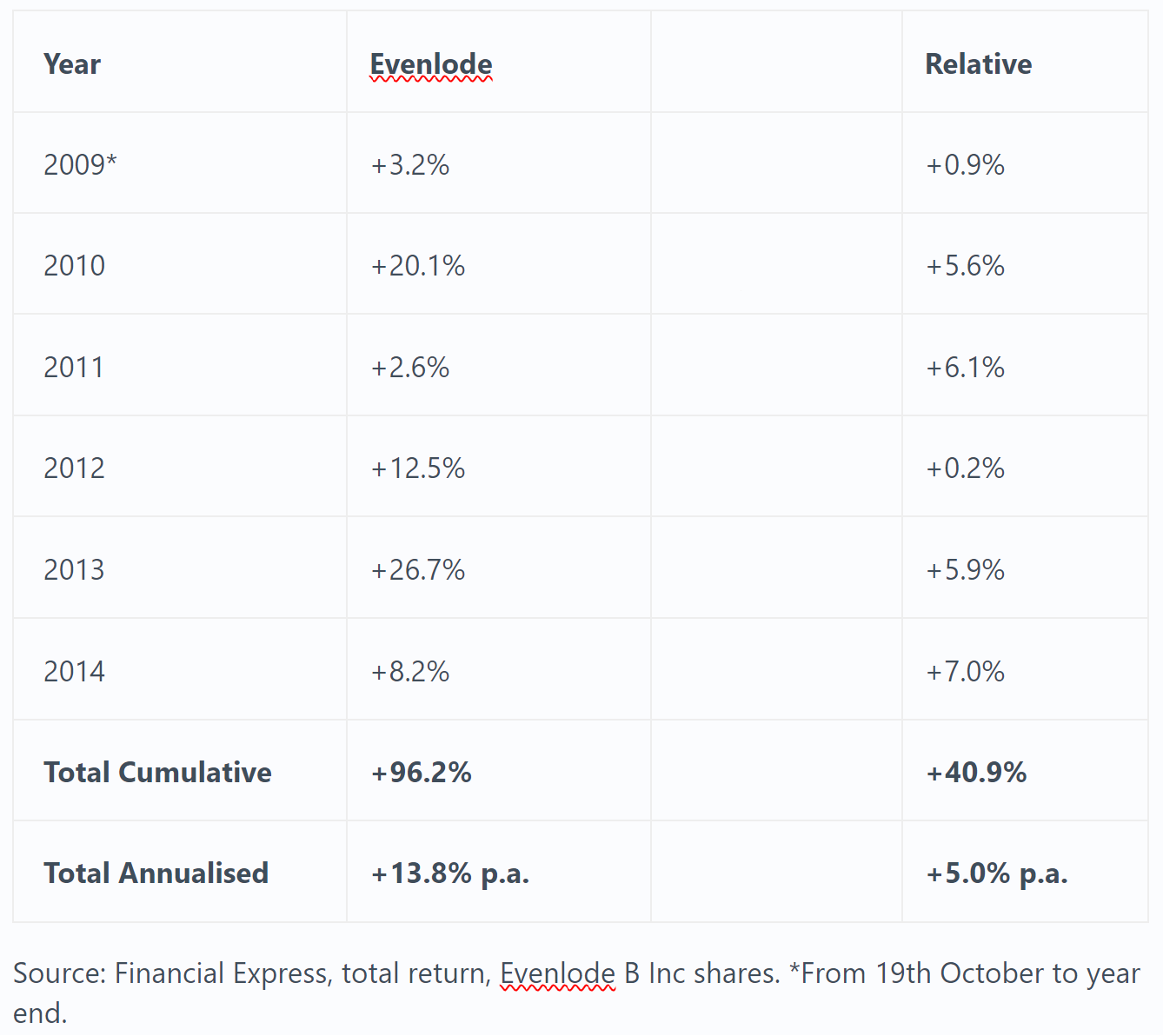

With another year added to Evenlode’s life, below are the results by calendar year versus the fund’s benchmark, the FTSE Allshare:

I must stress that while all the numbers in the last column happen to be positive, this will not always be the case (and, in fact, very nearly wasn’t in 2012). We construct the Evenlode portfolio from the bottom up, and for the long-term. Our attraction to high quality, asset-light stocks results in a portfolio that looks very different to the UK market. Despite our bias towards larger companies, Evenlode’s active share (the percentage of the portfolio that has no overlap with the overall UK market) is currently 77%. We think our approach is well placed to achieve long-term outperformance. But over shorter time periods, there will be certain markets (for instance, when commodity and banking shares are sharply outperforming) where this is unlikely to be the case.

Ben and I are committed to managing the fund in this way for the very long run. We are also happy to announce that we will have a new investment analyst, Chris Elliott, joining us at the beginning of March. Chris studied economics and mathematics at Cambridge and joins us from the Oxford University Press where he has been a software engineer for the past five years. Welcome to the team Chris!

Dividends

Dividend growth has been harder to come by in the UK market during 2014. In this context we are pleased that we have been able to increase each of the fund’s first three quarterly dividends by more than 10%*.

Looking ahead the prospects for dividend growth are reasonable for the stocks we follow. It is a difficult economic environment, and revenue growth is harder to come by than it has been in the past (particularly compared to the pre-crisis era). However, there are some mitigating factors. In aggregate, the underlying companies in the portfolio are generating a level of free cash flow that comfortably covers the dividend even after all capital investment required for future growth**. This is reassuring, particularly in the context of a UK market where many business models are struggling to generate any spare cash at all, let alone enough to cover a healthy dividend***. The recent weakness in the pound will also provide a tailwind in 2015 for the dividends of many UK listed multinational companies. Another trend worth noting is that for several of our large consumer branded goods holdings, the cash-flow cycle is set to turn more positive. At Unilever’s investor day in December, for instance, finance director Jean Marc Huet noted that recent elevated levels of capital expenditure, driven by investment in emerging market infrastructure, will now begin to reduce. This reduction will have a significant effect on the annual level of free cash flow available for shareholders. We think similar trends are likely to develop at Diageo and Procter & Gamble, following several years of (relative to their own histories) heavy investment.

Deflation Now, Inflation Later

"Is debt transitory? Not in countries whose response to debt-induced crises is to pile on more debt – which is to say, in just about every country."

Jim Grant, Interest Rate Observer

The economic outlook for 2015 is very mixed. Emerging markets - led by China – continue to slow, and countries heavily dependant on commodities, such as Russia and Venezuela, look vulnerable. Meanwhile, the eurozone remains mired in a debt deflation with no fundamental resolution in sight and more generally - despite more than six years having passed since the Great Financial Crisis - global indebtedness remains at a similar level to 2007. Government austerity and higher consumer savings rates are likely to remain a feature for some time to come, weighing on growth and prices.

Simultaneously, the potential for future inflation builds quietly in the background, thanks to extremely loose monetary policy all over the planet, both in the form of miniscule interest rates and quantitative easing (QE). This process is likely to continue in 2015 as central banks in Europe, Japan and China take up the QE baton from the Federal Reserve. I suspect deflationary forces will continue to prevail in 2015, but I also think the possibility of higher inflation in the longer-term should be taken very seriously.

As Ben discussed in last month’s investment view (From Macro to Micro) we aim to insulate the portfolio from macroeconomic risks such as deflation and inflation, rather than positioning the portfolio based on short-term predictions. A benefit of intangible asset businesses is that they tend to be relatively good at coping in both deflationary and inflationary conditions, thanks to their pricing power and strong and resilient cash generation. To put it simplistically: the price of washing powder didn’t go down a great deal during the 1930s (and people kept buying it) – but the price also went up a lot in the 1970s. And crucially, higher prices were translated into higher cash-flows for asset-light businesses, rather than all being absorbed in rising capital expenditure requirements (as was the case for many asset-intensive business models)****

Cheaper Oil

A big unknown for 2015 is exactly what the impact of the recent -55% fall in the oil price will have on global economies and stock markets. There are some clear negative impacts: commodity-producing companies and countries are already suffering. There is also the potential for yet untold repercussions on financial institutions and corporate and sovereign bond markets.

But the fall in oil will also have some hugely positive offsetting effects. It will provide some significant relief to the global consumer: from tuk- tuk drivers in Mumbai to pick-up truck drivers in the Mid-West. US consumer confidence is hitting highs not seen for many years, and several of the consumer facing companies we follow are beginning to suggest some early signs of improvement in their US businesses. Economist David Rosenberg estimates that oil’s recent fall may add as much as 0.7% to global growth this year.

Valuation

Meanwhile, on the valuation front, the aggregate picture has not changed much since the start of 2014. On our long-term estimates, the UK market is trading a little above fair value, having moved gradually back from a position of significant undervaluation in 2009. Given this more elevated valuation level, returns from the UK stock market over the coming five years are highly unlikely to repeat those of the last five. This is something we are keen to stress to our investors - it’s important to have realistic expectations!

With some selectivity, however, we think reasonable returns are still available for the careful investor, and we remain open to changing the portfolio incrementally as the opportunity set gradually shifts. Recently, this has involved a move back towards some of the smaller companies in our investable universe where better value and more attractive dividend yields have begun to re-emerge. Conversely, we have reduced several larger company holdings on valuation considerations. Our exposure to large companies has fallen in aggregate from 85% in the summer to 75% today.

To sum up, 2015 looks set to present plenty of challenges and cross-currents. Last week Warren Buffett described the stock market as a drunken psycho, and I expect it will spend the year (as it often does) staggering from one piece of news-flow to another in that vein. We remain cautiously optimistic on the fund’s long-term prospects, and I look forward to updating you on Evenlode’s progress over the coming year.

Hugh Yarrow, Investment Director

15 January 2015

Please note, these views represent the personal opinions of Hugh Yarrow as at 15 January 2015 and do not constitute investment advice.

*+13% for B Inc shares, Q1-Q3 2015 (year end February 2015). At this stage we anticipate the full year increase will also be in the low double-digits. The fund’s dividend growth this year has been helped by three main factors: steady underlying dividend growth from portfolio holdings, a special dividend from Compass last summer, and – at the margin - the recycling of capital from lower yielding stocks to more attractively valued higher yielding stocks (an on-going process, as it has been since the fund’s launch).

**There are some quite large areas of the market – the oil majors and several utility stocks for instance – where free cash flow generation not only doesn’t cover the dividend, but is in fact negative. This means that not only the entire dividend, but also some of the company’s required growth investment, is unfunded. These companies face a Hobson’s choice: reduce the dividend today or risk underinvesting in the business long-term, and therefore lowering future dividend growth potential.

***2015 free cash flow yield is approximately 6% (Source: Canaccord/Evenlode: net free cash flow after interest, tax, maintenance and growth capital expenditure).

****Warren Buffett wrote a good piece on this - Berkshire Hathaway Annual Report 1983 (Appendix), Goodwill and Its Amortisation, The Rules and The Realities